Topics

Latest

AI

Amazon

Image Credits:Xiuxia Huang(opens in a new window)/ Getty Images

Apps

Biotech & Health

clime

Image Credits:Xiuxia Huang(opens in a new window)/ Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:State of LatAm SaaS 2024

Enterprise

EVs

Fintech

fundraise

Gadgets

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

place

Startups

TikTok

shipping

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Hipster burnt umber shop in Budapest oftenlook the same , as if they were in Portland , Oregon , or São Paulo , Brazil . That ’s one of the effects of globalization : Some trends have become ubiquitous . But take a closer look , and you ’ll before long realize that even things that look the same can actually amount in unlike flavor .

Take SaaS , for instance . No matter where you are , buying software system in a box seat isa matter of the past tense . But the SaaS business organisation that are enabling this shift are dealing with a dissimilar set of ruler depending on where they are based , which leads them to diverging paths .

This is dead on target in India , where SaaS is very much on the rise ; the local SaaS market could reach $ 50 billion in annual recur tax revenue by 2030 , harmonize to areportfrom Bessemer Venture Partners . But that same firm also take down that Indian SaaS businessesdiffer from their U.S. peers : The former are more effective , which could “ aid them on their path to global leading . ”

TheState of SaaS LatAm 2024 reportsuggests that this could be dependable in other emerging country as well .

issue in collaboration with blog - turn - VC - firmSaaSholic , the report show that many Latin America ’s SaaS businesses outstrip others at efficiency metrics such as last one dollar bill retentiveness and customer learning toll payback . But capital scarcity also put a limit to origination , although AI could change that .

Forced efficiency

client acquisition cost ( CAC ) is a key information tip for any SaaS startup ; it is the base of two other of the essence metrics : CAC retribution ( how long it claim for a customer to “ return ” its acquisition cost ) and LTV / CAC ratio ( where LTV is the lifetime value a party will get out of a given customer ) .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

On both counting , the State of SaaS LatAm 2024 report detect that several company in its sample of 400 startups outgo global averages highlighted by theCapchase SaaS Benchmark Report 2023 .

As NFX principal Anna Piñol commented on the findings , “ most top - decile respondents report CAC Payback Periods that are 32 % low than U.S. benchmarks . ” Her depth psychology is that this advise that LatAm mart are far from being impregnate versus some more matured markets — but it also suggest that they have less leeway .

“ In the U.S. , investors typically search for an LTV / CAC proportion of at least 3x , while companies in LatAm are carry to a higher measure , ” note Manoel Lemos , a cope partner at Redpoint eventures . This is n’t unfounded : “ The high figures are expected due to higher interest rates and cost of capital . ” But it still place the measure higher for venture - backed SaaS in LatAm .

lend in thedeclining volumesof venture capital run into the part , and it is easy to see why many LatAm SaaS startup — one - third of the sample distribution — go for the bootstrapping path . But even those who raise large amount of funding in 2021 live that the next knowledgeable round might be elusive . As a upshot , bridge round have become the new normal , but they do n’t needfully mean that a company is struggling .

“ LatAm startups got 99 problem , but runway ai n’t one , ” the report argues , noting that “ operating at ‘ near - breakeven ’ has always been LatAm ’s specialty . ” That set them aside , even without the bootstrapping prejudice : “ If we only analyze inauguration that have enhance VC money , the medial LatAm company with more than $ 1 ARR still has 15 months longer rails than their U.S. vis-a-vis , while the top decile has 15 month more runway . ”

Clicksign vs. DocuSign

Reports like this have to rely on anonymized datum to ensure that founders will in reality open up about their metrics . While helpful , that ’s also abstract , so let ’s add an example of our own : Clicksign .

This Brazilian digital signature startup contribution a lot of similarities with DocuSign . That ’s particularly interesting for comparison purposes : DocuSign is public , at least for now . This think that its key metric unit are in the public domain of a function , too .

DocuSign could be suffering from a pandemic outgrowth hangover

Clicksign is still a private companionship , but Centennial State - father Michael Belfer Bernstein shared a key data point that we can compare with DocuSign , and the gap is pretty clear : “ DocuSign has a CAC paybackof 79 month . Clicksign has a CAC vengeance of 5.6 months , ” he said .

Before you say we picked below the belt , allow ’s note that Clicksign , too , conducted layoffs , letting approximately one - third of its work force goin tardy 2022 . But healthy metric mean it is well grade to maintain its leaders in its own market . “ Today we dish 28 million people , which constitute 13 % of the Brazilian population , ” Belfer Bernstein say .

Innovation under pressure

If you have ever faced Brazilian bureaucracy and itsobsessionwith authentified signatures , it is easy to see how Clicksign is an melioration . But it ’s not station anyone to Mars , either ; it would have had a operose sentence raising financial support if it did .

“ In Latin America , SaaS startups have democratized technology rather than created rocket - science - level innovation , ” said Rodrigo Fernandes , CFO atPingback . He ’s the research lead for the report , which several VC firm also supported .

SaaS - focused fundABSeedis one of these , and mate Franco Zanette shared thoughts with TechCrunch+ .

“ Most of LatAm ’s instauration is about ‘ go to market ’ efficiency and how to rescue continent - size digitalization , with its independent downside being a still scarce region for product design , with most of the companies being copycats and solutions with pricing and support fit to the region ’s needs , ” he enunciate .

Does that intend that the region ca n’t make spheric leaders ? Certainly not ; efficiency and gainfulness do heart-to-heart doors , especially in the current environs . As does a proven track record and outside connections , Zanette observe .

Neither does it make thick tech startups an impossibleness . lawsuit in peak : cybersecurity startup Auth0 , which Okta bought for $ 6.5 billion in 2021 . But most Romance American inauguration are n’t rooted in deep creation — at leastnot yet .

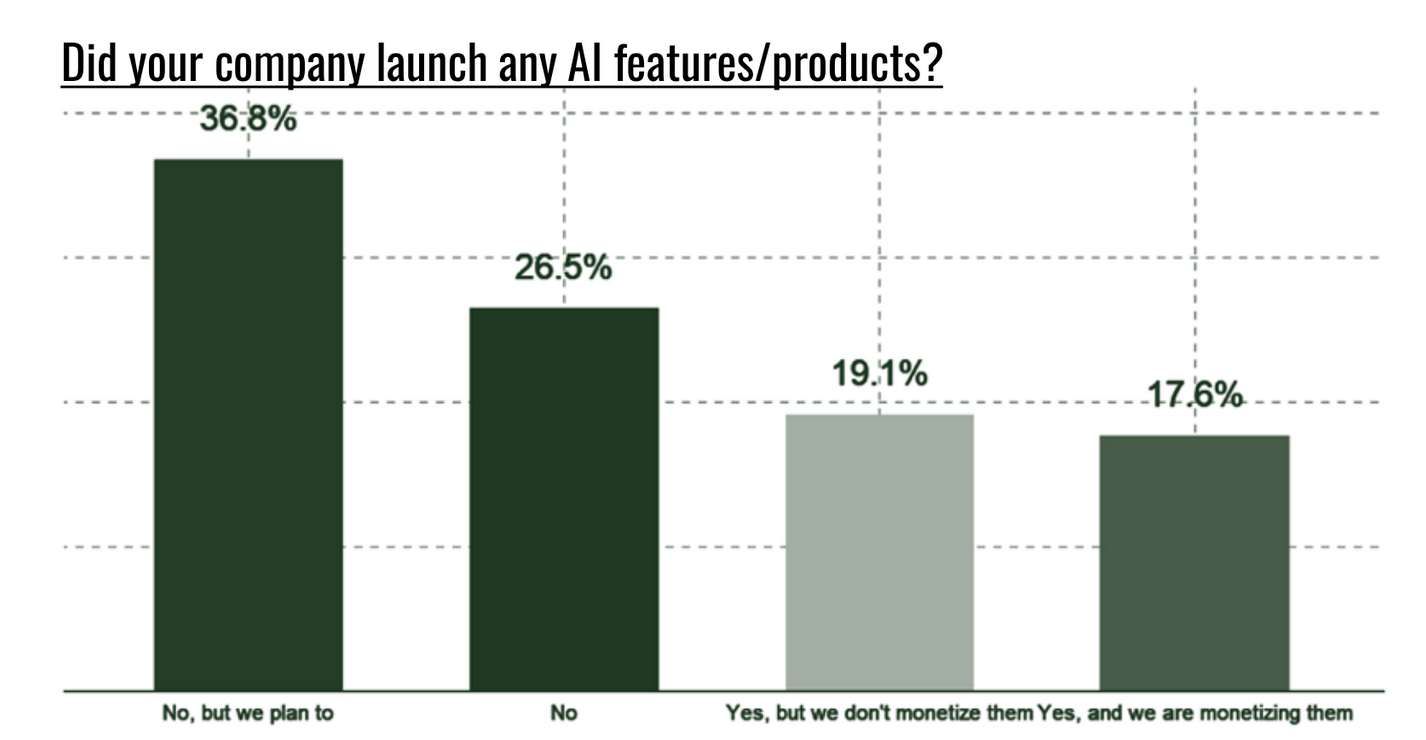

When it comes to AI , Fernandes and his co - author found data point that made them optimistic : “ Latin American companies are on the veracious track with the integration of AI into their business models , ” they write . Like elsewhere , not all SaaS founders have integrated AI yet , but many design to .

This is mildly encouraging ; relative working capital scarceness will make it difficult for the region to be at the vanguard of AI founding . But at least it ’s not set to lose out on this Modern wave , which could enable its SaaS byplay to bring thedigital transformationthe region call for at an even faster tread .