Topics

late

AI

Amazon

Image Credits:twomeows(opens in a new window)/ Getty Images

Apps

Biotech & Health

mood

Image Credits:twomeows(opens in a new window)/ Getty Images

Cloud Computing

Commerce

Crypto

Figure 1.Image Credits:BMW i Ventures

go-ahead

EVs

Fintech

Figure 2.Image Credits:BMW i Ventures

Fundraising

Gadgets

Gaming

Figure 3.Image Credits:BMW i Ventures

Government & Policy

Hardware

Figure 4.Image Credits:BMW i Ventures

Layoffs

Media & Entertainment

Figure 5.Image Credits:BMW i Ventures

Meta

Microsoft

privateness

Figure 6.Image Credits:BMW i Ventures

Robotics

Security

societal

infinite

Startups

TikTok

Transportation

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

telecasting

Partner Content

TechCrunch Brand Studio

Crunchboard

get through Us

Until lately , many inauguration have prioritize growth at all toll , using abundant venture capital to acquire users and rule markets without regard for profitability or sustainability . However , late market conditions have transfer toward “ effective outgrowth , ” balance growing with profitability to create a sustainable path to surmount .

As investors , we are laser - focused on identifying efficient growth early in the company ’s journeying . What are the early indicators of a startup ’s long - term winner and effective maturation ? As we attempt to encounter the answer to this question , we apply various analyses , some of which we cover in this article .

The flaws of using LTV/CAC — why we use cohorts to assess sales efficiency

Before hop into our analyses , we want to get across why a commonly used metric could be shoddy . Often , investors judge the go - to - market engine of a business with the LTV / CAC ( lifetime value / client acquisition cost ) metric , but this metric unit is frequently immaterial for other - stage companies for a few reasons :

move over the various means LTV can be calculate , the lack of steady - state churn rate datum , and the forecast economic value of the LTV / CAC reckoning , there may not be a true sense of what drives acquisition and holding of a company ’s customers . Considering the shortcomings of the LTV / CAC computation , we purport using a cohort analysis to diagram how long it take to bear back the initial sales and merchandising spend to acquire each cohort .

What are cohorts, and why are they important?

A cohort analytic thinking is a method to assess business by clustering customers into groups ( cohorts ) starting at different point of acquirement and keep how they behave over defined intervals of time . trail behaviors include the number of rules of order set , amount of spend , and number of feature used over periods .

One can implement this analysis to various business models , such as SaaS , fintech , and even marketplaces ( back then , we used it to analyzea ride - hail party ) . An analysis of cohort is valuable because observing a particular variableover timeallows one to understand the concern narrative of receipts , acquisition toll , and churn over a single age bracket and across age bracket .

Here ’s how we deal the analytic thinking :

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

As investor , we leverage cohort break down to illuminate the mechanisms of growth , retention , and sales efficiency .

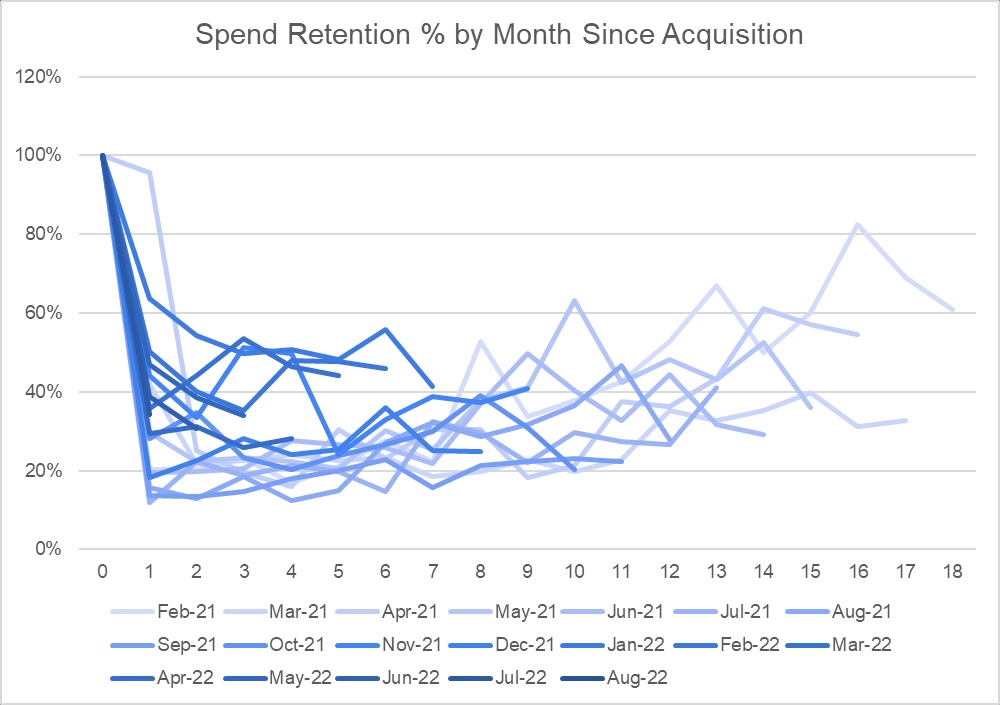

In build 1 , you may notice that :

By analyzing cohorts , you may also deduce that customers ’ spending is seasonal , receipts ontogenesis stem from increasing sales bulk rather than monetary value increases , or sales efficiency improves over metre due to the stickiness of a mathematical product .

Rolling payback analysis helps us identify efficient growth

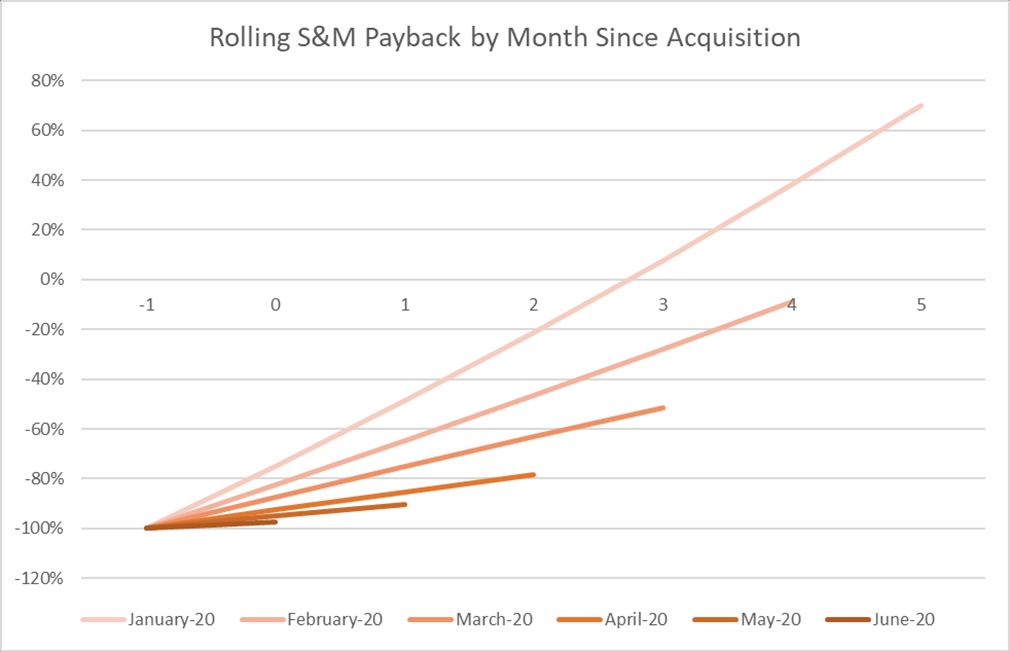

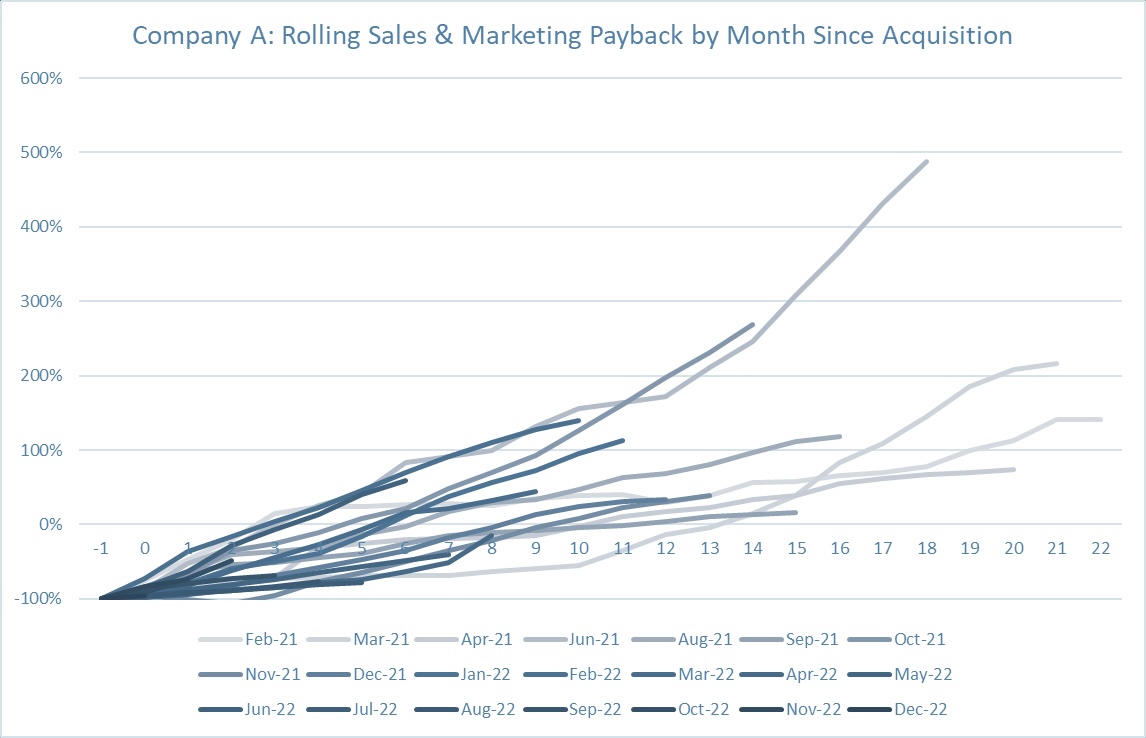

By conducting a rolling sales event and marketing payback analysis , we can determine how long it accept for the company to pay back the initial accomplishment price within a undivided age group and across multiple age group . Figures 2 and 3 show object lesson of an improving acquisition vengeance and a deteriorating accomplishment payback .

In Figure 2 , we see that the company is acquiring Modern cohorts ( denote with coloured shades of blue ) who pay off back the attainment costs more promptly than the older cohorts . This can ensue from factors such as increase margin while maintaining flat acquisition drop or increasing customer tax income ( both new and retained ) over sentence .

pattern 3 indicate an example of devolve learning payback . The troupe is acquiring newer cohorts who ante up back the acquisition costs more slowly than old cohort . This can be a result of factors such as increasing sales and marketing costs while customer revenue or staring profit is held ceaseless or decrease over metre .

As hint in Figures 2 and 3 , we , as investor , want to understand the levers of emergence through longitudinal data point exhibit from age group . valuate the trilled skill retribution period gives us a window into the engine of growth . The payback flow is a function of ( 1 ) gross margins , ( 2 ) customer tax income and retentivity , and ( 3 ) initial gross revenue and marketing acquirement costs . Toggling these variables will give us an discernment of how a companionship generates time value .

This psychoanalysis is in particular helpful if we can compare two companies . strike we have two quick mature ship’s company in terms of revenue that are operating in the same space . Suppose we notice that one ’s payback point is declining for late cohorts . In that case , we can conclude that growth is becoming more efficient over time due to increasing margins , increase customer tax income , decreasing acquisition costs , or all of the above . If the other caller ’s payback period grow for later cohorts , we can deduce that increase sales and marketing spend is the increase lever .

As such , we recommend that founders of all phase with applicable business poser cipher the sale and merchandising payback full point of cohorts , as the depth psychology will take detailed insight to see what lever are force back increment .

Case study: Rolling payback analysis in action

Walking through a case subject area that compare two companies using a rolling sales and marketing retribution analysis will exemplify its ability to convey how businesses drive growth . Say we have two competing companies ( Company A and Company B ) in the United States that provide market for selling industrial parts . Company A is a relatively new musician compared to Company B , which initiate one year before Company A. Company B has developed a characteristic to bundle multiple orders and embark them together . In contrast , Company A still has that feature upcoming within the product roadmap .

From viewing the numbers in Figure 4 , we can see that Company B has a higher final tax revenue and take rate percentage ( how much money a troupe makes on a dealing in the marketplace ) compared to Company A. In 2022 , Company A achieved $ 3.6 million in net revenue with a 12 % take rate , implying $ 30 million in gross tax income . In the same class , Company B scaled order across the res publica with about $ 21 million in net taxation with a 16 % take pace , mean $ 134 million in gross gross . In plus , Company A and Company B grew by more or less 200 % in net gross for 2022 . Despite being more matured than Company A , Company B is turn just as fast as the younger competitor from a net revenue perspective . Thus , from a topline perspective , Company B looks more attractive than Company A.

Now we will plot the rove sales and marketing skill payback :

For Company A , more than half of the monthly age bracket can pay back the acquisition costs at an average of seven months . For Company B , we see that approximately 14 % of the cohorts could pay back the acquirement toll . By comparing the rolled payback charts , we can see that Company B is burning cash to acquire growth . At first glance , companies showing high ontogeny may look interesting , yet this analysis shows that companies demonstrating effective growth put up much more compelling investment compositor’s case .

Getting beyond LTV/CAC calculations

Now that late market condition have pitch toward “ effective ontogenesis , ” it ’s prison term for startups to get the picture profoundly into fundamental metric function and go beyond LTV / CAC figuring . To balance emergence with profitability , we recommend conducting a rolled retribution analysis using the process above .