Topics

Latest

AI

Amazon

Image Credits:Kuzma(opens in a new window)/ Getty Images

Apps

Biotech & Health

clime

Image Credits:Kuzma(opens in a new window)/ Getty Images

Cloud Computing

Commerce

Crypto

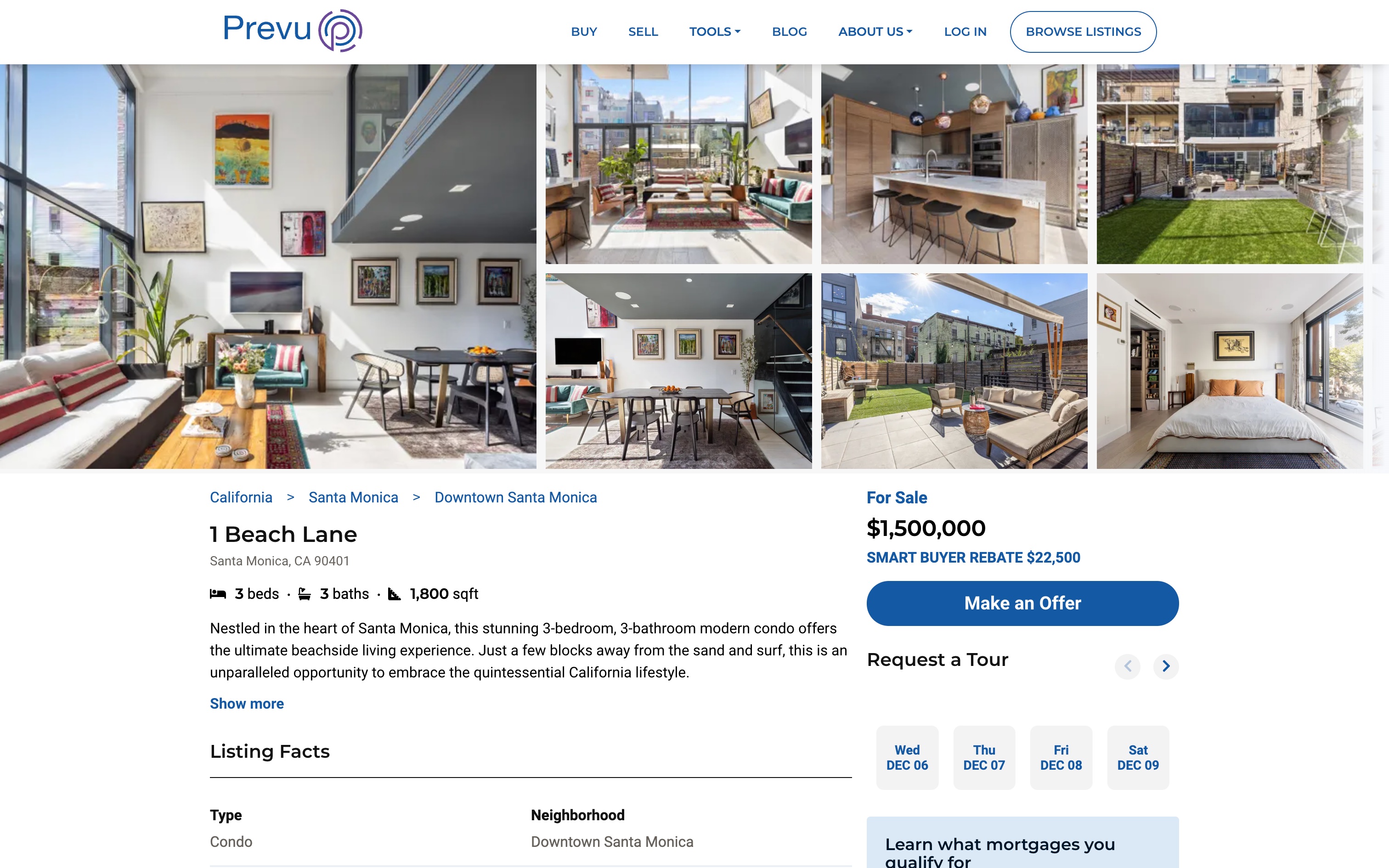

Image Credits:Prevu

Enterprise

EVs

Fintech

Fundraising

widget

punt

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

protection

Social

outer space

Startups

TikTok

transit

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

television

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

The traditional role of the actual estate agent has long been challenged as the net has made it easy for people to search for , and tour of duty , homes .

Historically , agents have received 6 % commission on home sales — a practice that is progressively being address into motion . The argument against it is that oftentimes purchaser have already done much of the legwork when identifying a home to purchase so the work of an agent is not what it once used to be pre - internet days .

Over the year , real land tech party such as Redfin have seek to upend the poser by rent factor as salaried employee but that has n’t always raise successful .

That has n’t deter a figure of startups in the space , though . New York – basedPrevu(pronounced preview ) is one such inauguration . It hires agents as salaried employee with healthcare benefits and retreat program , and mesh under the premise that “ the role of an agent is changing . ”

“ It ’s becoming much more of an adviser in an important dealings more cognate to wealth management , ” say Prevu co - founder and co - CEO Thomas Kutzman . “ So the federal agent really becomes an extension of a brand as oppose to being their own short byplay . ”

Further differentiating Prevu ’s stage business is its offer of a rabbet to buyers if they purchase a home using its program .

In an surround where interest rate are sky high — bulk large between 7.5 % and 8 % — and there ’s a famine of home available in most grocery store , the ability to get cash back when buying a home can be attractive .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Since launching its digital home - buying platform in June of 2017 , Prevu has help over 1,200 home buyers buy home totaling over $ 1.5 billion Charles Frederick Worth of real estate . Homes have drift in price from $ 250,000 to an $ 8 million apartment in New York City .

Over meter , the ship’s company say it has save consumer an norm of $ 23,000 per rest home leverage with its rebate program .

Prevu aims to modernize the client experience by allowing home buyers to look for menage , schedule hitch , draft offers and collaborate with a consecrated agentive role through its digital offering . About 50 % of its customer issue forth on to the platform quick to make a verbatim offer on a home , and seek expertise with the more complex parts of the leverage process .

“ citizenry come for the rebate but detain for the user experience , ” Kutzman say . “ Prevu offer an Amazon - like feel with up - to - the - instant updates , such as text messages when tours are support . It ’s much more of what masses are habitual to in every other upright of their life , but they have n’t been receiving it in existent landed estate . ”

Today the company is harbinger that it has advance $ 6 million in a Series A financial support round that included participation from newfangled investor Citi , Alpaca Ventures , Winklevoss Capital , RiverPark Ventures , Metropolis Ventures , Simplex Ventures and Liebenthal Ventures . They joined existing angel Alpaca VC , TYH Ventures and Blue Ivy Ventures , all of which put money in Prevu ’s $ 2 million seed round in late 2019 . Since that round , the startup has seen its one-year tax income grow by nigh 10x , according to Kutzman .

Prevu ’s geographical footprint has grown to 12 major metropolitan grocery from its initial market of New York City at the time of that seed rung , with six of these market launching in the past six to nine months . It presently go in New York City , Boston , Philadelphia , New Jersey , Washington , D.C. , Maryland , Northern Virginia , South Florida , Southern California , San Francisco Bay Area , Seattle , Denver and Austin .

The startup currently get gross from direction on each real estate of the realm transaction — tot 1 % to 1.5 % of dealing value , meshing of client rabbet .

The buyers ’ agent commission alter from transaction to transaction depend on what is offered by the seller . In a scenario where the buyer ’s broker mission is 3 % , for exemplar , the abode buyer would receive up to 1.5 % as a rabbet and Prevu as a company would retain the other 1.5 % . Prevu agent do earn a “ small ” commission on every dealings in addition to their salaries .

Buyers receive the commission rebate via check after closing .

Down the credit line , Prevu plans to begin offering access to more services foresightful - condition associate to mortgage , title and other vendee - related services . In fact , last year , it purchased mortgage engineering science from the now - defunct proptech Reali , whichshut down last year . Part of its Modern majuscule will go toward that , as well as to accelerate development into new markets and expand in exist mart such as Texas and Florida . Long - term , it draw a bead on to be a nationwide stain .

Making home buying “more attainable”

So besides rebates , what is Prevu doing that ’s different from its competitors ?

It boil down to its proprietary technology , Kutzman believes .

“ A lot of multitude have tried to change the cost of the service , but they do n’t actually introduce on the factual technology that tolerate them to service the concern , and ultimately they had major problems scale , ” he said . “ We create a expert consumer experience , but also it ’s really also the back conclusion of ‘ how does that collaboration pass between the consumer and the agent ? ’ ”

That engineering , too , has help the ship’s company abide skimpy from a hiring standpoint . Prevu currently has 25 employee , the majority of whom are agents .

“ We ’ve charter as we ’ve gone to fresh market but we have n’t had hiring be a constriction like a lot of other rival , ” Kutzman said . “ If you attend at traditional brokerages , it ’s all about hiring other agents . Our average agent does 40 deals per yr , whereas a top - tier brokerage house will do somewhere between five and eight deals per year . So we have a higher level of efficiency where the wage can work . ”

conscientious objector - founding father and co - CEO Chase Marsh tell buyers are using the rebates in a salmagundi of ways .

“ With the affordability crisis , interest rate having done what they ’ve done , and home prices not hail down to a large degree , people are using hard cash back to do thing like furnish their new home base , win bidding wars , or to lower mortgage rates by buying point on their mortgage , ” he said .

Jeff Meyers , a director at Citi ( which wrote the largest halt in the Series A round ) , told TechCrunch via email that he was absorb to a few things about Prevu , including its Smart Buyer mission rebate because it “ make menage purchasing more attainable . ”

Plus , he was impressed with “ its purchaser - focused platform , ” which provides individuals with “ more dominance and greater memory access to enhanced digital tools . ”

Daniel Fetner , a cosmopolitan collaborator at Alpaca VC , noted that his firm was also an early investor in real acres company Compass and has watch out “ tight ” as the residential home purchasing experience has changed over the years .

“ We believe that Prevu ’s value proposition is a no - brainer for today ’s ‘ chic buyer ’ who want to practice Prevu as a champion in the early miles , and as an expert at the terminal of the dealing , ” he said .

require more fintech news in your inbox ? signal up for The Interchangehere .