Topics

late

AI

Amazon

Image Credits:Superscale(opens in a new window)

Apps

Biotech & Health

Climate

Image Credits:Superscale(opens in a new window)

Cloud Computing

Commerce

Crypto

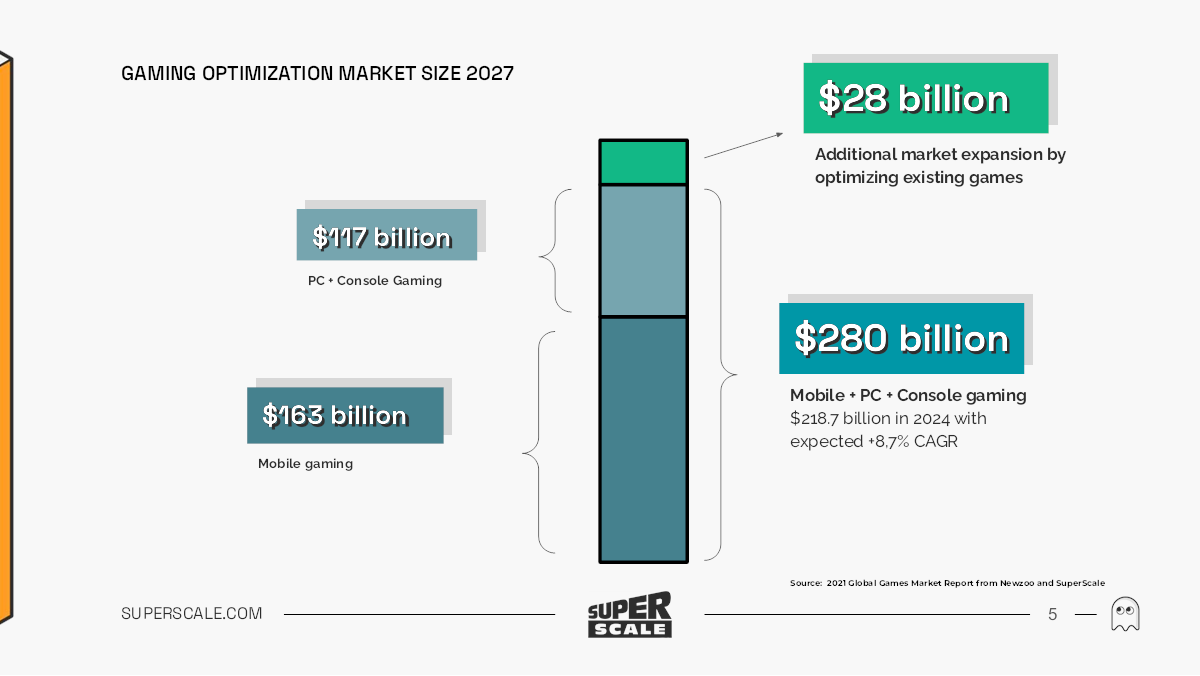

[Slide 5] This will certainly catch the eye of investors.Image Credits:SuperScale

Enterprise

EVs

Fintech

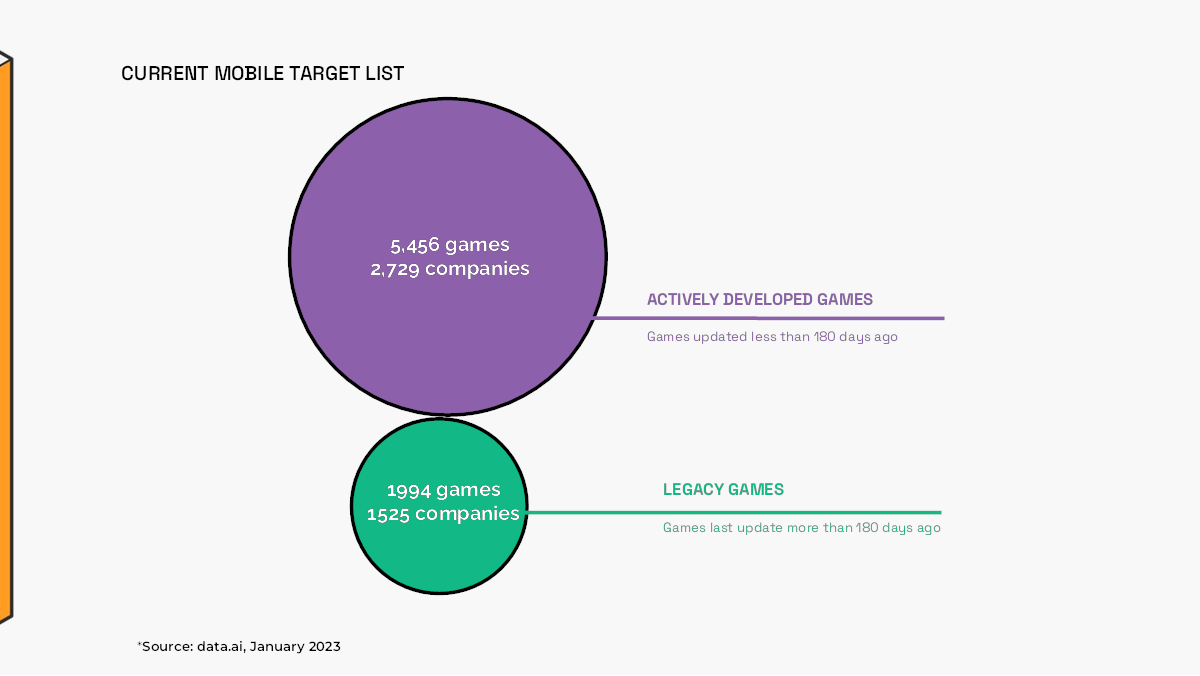

[Slide 7] SuperScale promises to go after two markets.Image Credits: SuperScale

fund-raise

Gadgets

stake

[Slide 18] Hell yes.Image Credits: SuperScale

Government & Policy

Hardware

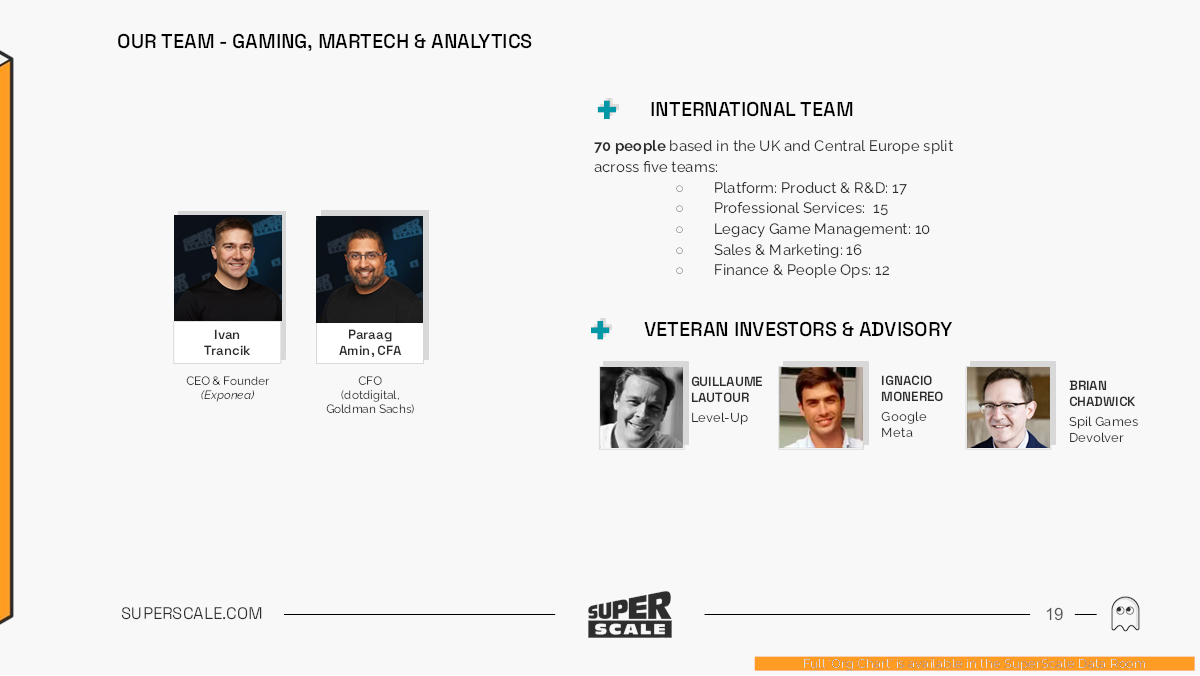

[Slide 19] That’s a big team.Image Credits: SuperScale

layoff

Media & Entertainment

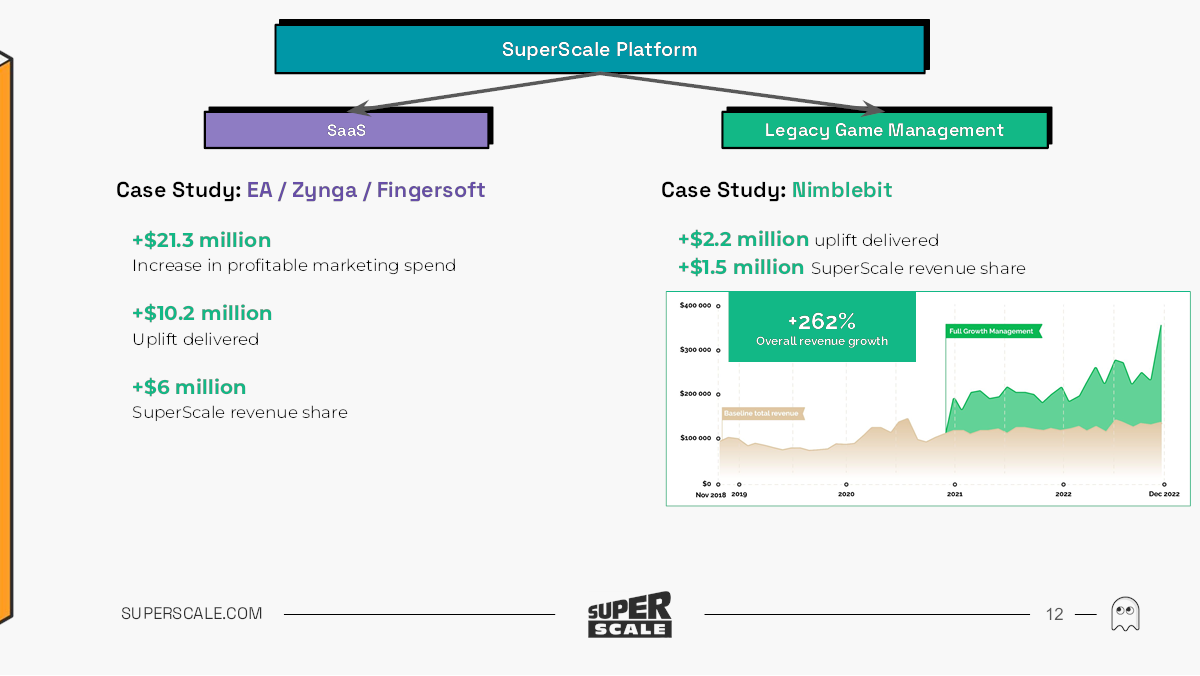

[Slide 12] Blink and you’ll miss it, but this slide includes some crucial business metrics.Image Credits: SuperScale

Meta

Microsoft

privateness

[Slide 16] What?Image Credits: SuperScale

Robotics

Security

Social

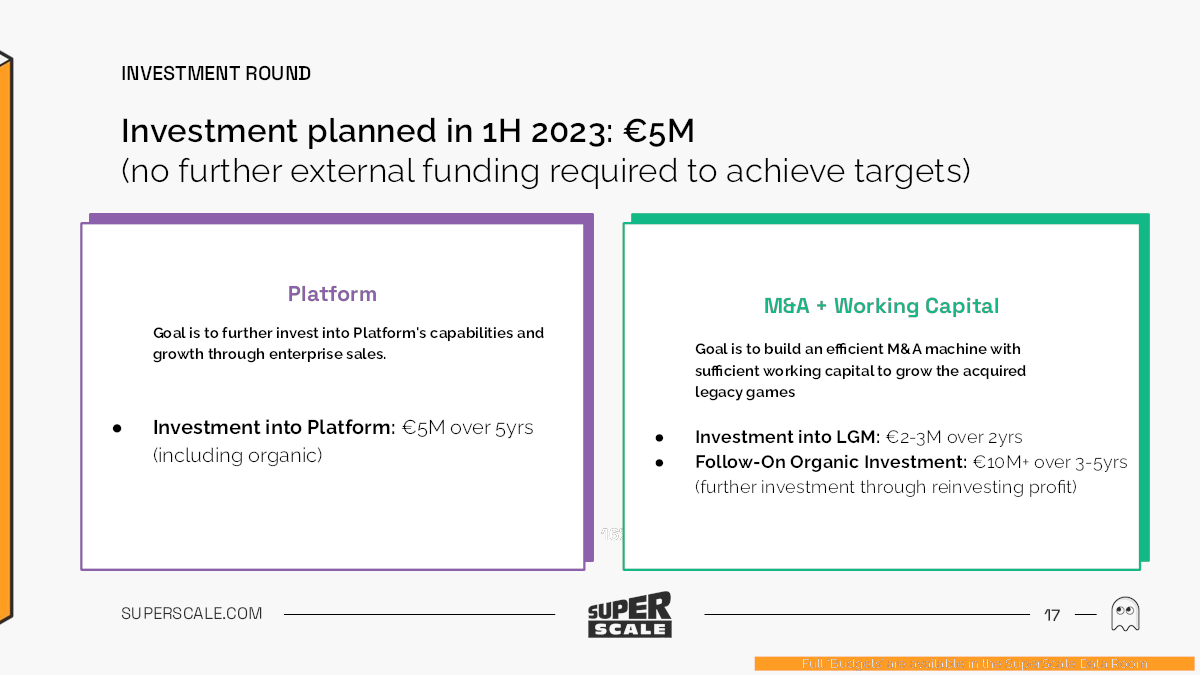

[Slide 17] Raising for a five-year runway?Image Credits: SuperScale

Space

Startups

TikTok

transit

Venture

More from TechCrunch

case

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

There are two industries that make a ton of money but they ’re traditionally largely brush aside by venture capital — flick and gambling . That comes as a spot of a surprise to many : speculation capitalists are eff for their neat eye on high - ontogenesis opportunity , predominantly cat their lot with technical school startups , health care institution , and the next big thing in the digital sphere . But Deadline reports thatmovies made $ 33.9 billion last yr , andglobal gaming revenue was $ 184 billion , according to Newzoo . Still , the proposition of invest in movies introduces hazard capitalist to a landscape far removed from the calculable metrics of SaaS platforms or the relatively predictable hazard of biotech .

Gaming and movies are extremely hit or miss , and that ’s the kind of unpredictability that ’s seldom embraced bytraditional venture chapiter investiture theses .

I am always particularly odd about pitch shot decks in the gaming diligence , so whenSuperScalethrew its lid in the ring , I was excited . The ship’s company is promising to make selling for games well-off , and given that great marketing is one of the all-important difference between an o.k. upshot and a smash - hit success , it tickle my curiosity nerve in a most delightful way .

We ’re looking for more unparalleled delivery deck to tear down , so if you require to submit your own , here ’s how you’re able to do that .

Slides in this deck

The company submitted a 22 - slide deck , but “ item of customers and customer caseful survey where we did n’t get approval for distribution are frame , ” grant to the company .

Three things to love about SuperScale’s pitch deck

SuperScale has an incredibly slick - look deck that get down right to the point . Twenty - two slides might seem like too many ( the optimum distance for a slide deck isaround 16 slidesthese days ) , but there are some interstitial slides and an appendix in this one , and those do n’t really weigh .

Let ’s take a feeling at some of the things that really operate .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Making your own market

gambling is a immense market , and investors do n’t need to be convinced of that . The question , then , is how to get a slice of that very tasty digital pie . SuperScale is taking some interesting leaps of faith here : The number are projection for 2027 , rather than babble out about the numbers today . But this glide do early in the deck ; if SuperScale can make a solid arguing for how it will be part of the machine that originate stake by 10 % , that ’s very interesting indeed .

It ’s bluff and brazen storytelling . Of of course , the company is now setting itself up for having to apportion a plan and show the receipts , but it ’s a ripe manner to get investors interested right off the bat .

A new lease on life

As a games optimization ship’s company , SuperScale has an interesting glide path , and this simple slide holds a smart promise : What if we can massively increase the lucrativeness of a secret plan that ’s already out there ? SuperScale ’s poser aims , in part , to give those games a fresh lease on life at a degree of the games release cycle where every one dollar bill that comes in is basically a bonus . The pack of cards is n’t bring in a big deal out of this , but I can see that being a really powerful sales technique to game studio — and if it ’s successful with bequest games ( at fundamentally no risk ) , would n’t it be chic to integrate SuperScale on new games , too ?

It ’s super smart , and investor will be capable to see that , too .

That’s how you do a summary

Design and almost - undecipherable text edition away , the message on this slide is keen :

I do it a good sum-up swoop . Give the investors all the thinking and talk point they demand to get worked up about an investment . It ’s a great approach .

Three things that SuperScale could have improved

Overall , this is one of the better pitch decks I ’ve see , but there are a few things that made me go “ hmm . ”

Wait, how big is your team?

When a company raises around $ 5 million , I typically expect a team of 10 to 15 . This squad slide came as a bit of a surprise :

pose this slide at the end of the deck of cards make me wonder about the seriousness of this inauguration . If it has five job units and 70 + team members , it throw the rest of the pack of cards out of belt . There ’s an ask slide , but no solid use of investment trust . You ca n’t sustain a 70 - person squad without take in significant revenue . The company is spending so much clock time talking about 2027 and its five - class plans , yet it totally glosses over how much money it ’s making .

There ’s some info about gross , but only in the phase of face studies :

Did you spot it ? SuperScale made $ 6 million from EA , Zynga and Fingersoft . And an additional $ 1.5 million from NimbleBit .

That ’s telling , but it ’s aterribleway of showing off this point of traction . A right traction sloping trough would display these numbers not as aggregate , but as revenue graphical record that show how much and how firm receipts is arise over sentence .

Why is SuperScale raising money?

It ’s confusing why the company is raising around $ 5 million when it ’s shit right tax income numbers .

This slide work almost no sense at all . On slide 12 , the party noted it had $ 7.5 million Charles Frederick Worth of taxation from just its fount study client . How many customer are there ? We do n’t screw . How much receipts is there in total ? No estimation . And what is it planning to do with the money ? Well , there ’s a microscope slide for that :

This slide is ugly . The fellowship say it is building an M&A political machine , paint a picture it is planning to gain the rights to legacy games and presumptively acquire them . That ’s awe-inspiring and all , but there needs to be a specific plan for that .

There ’s also the internal inconsistencies here : It says it call for $ 5 million to achieve object , but then says it will have “ follow on constitutive investment ” through reinvesting gain .

In the M&A space , $ 5 million is almost no money at all , so now I ’m very odd about who the skill target would be , and how the troupe presume these skill will form toward its bottom line .

Tell a coherent story!

SuperScale , on first read - through , seemed like such a wonderful investment opportunity , but as I started thump and spur at the deck , it made less and less common sense . The caller seems to require to acquire other companies ( or is it game ? ) . It has 70 people on faculty , but it ’s only raising $ 5 million . It does n’t partake its past achiever , nor how it is planning to find the next success it needs .

I think a much better way of telling this story , overall , would be to have an end - to - end story , told consistently :

Thatstory would make sense to investors .

The full pitch deck

If you want your own sales talk pack of cards teardown featured on TechCrunch , here ’s more information !