Topics

in vogue

AI

Amazon

Image Credits:PM Images / Getty Images

Apps

Biotech & Health

Climate

Image Credits:PM Images / Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:Index Ventures

Enterprise

EVs

Fintech

Image Credits:Index Ventures

fundraise

Gadgets

Gaming

Image Credits:Index Ventures

Government & Policy

Hardware

Image Credits:Index Ventures

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

Space

Startups

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

newssheet

Podcasts

picture

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

As part of the Metrics That Matter series , we ’ve spell aboutthree analyses to track the path to profitabilityandtwo metric function to calibrate retention and expansion . These prosody serve as both output signal and inputs . They are outputs from the activities of people at companies working hard to make compelling products , pass on them to customers , and drive the stage business forward . They are also input to valuation , a topic especially apposite in today ’s marketplace .

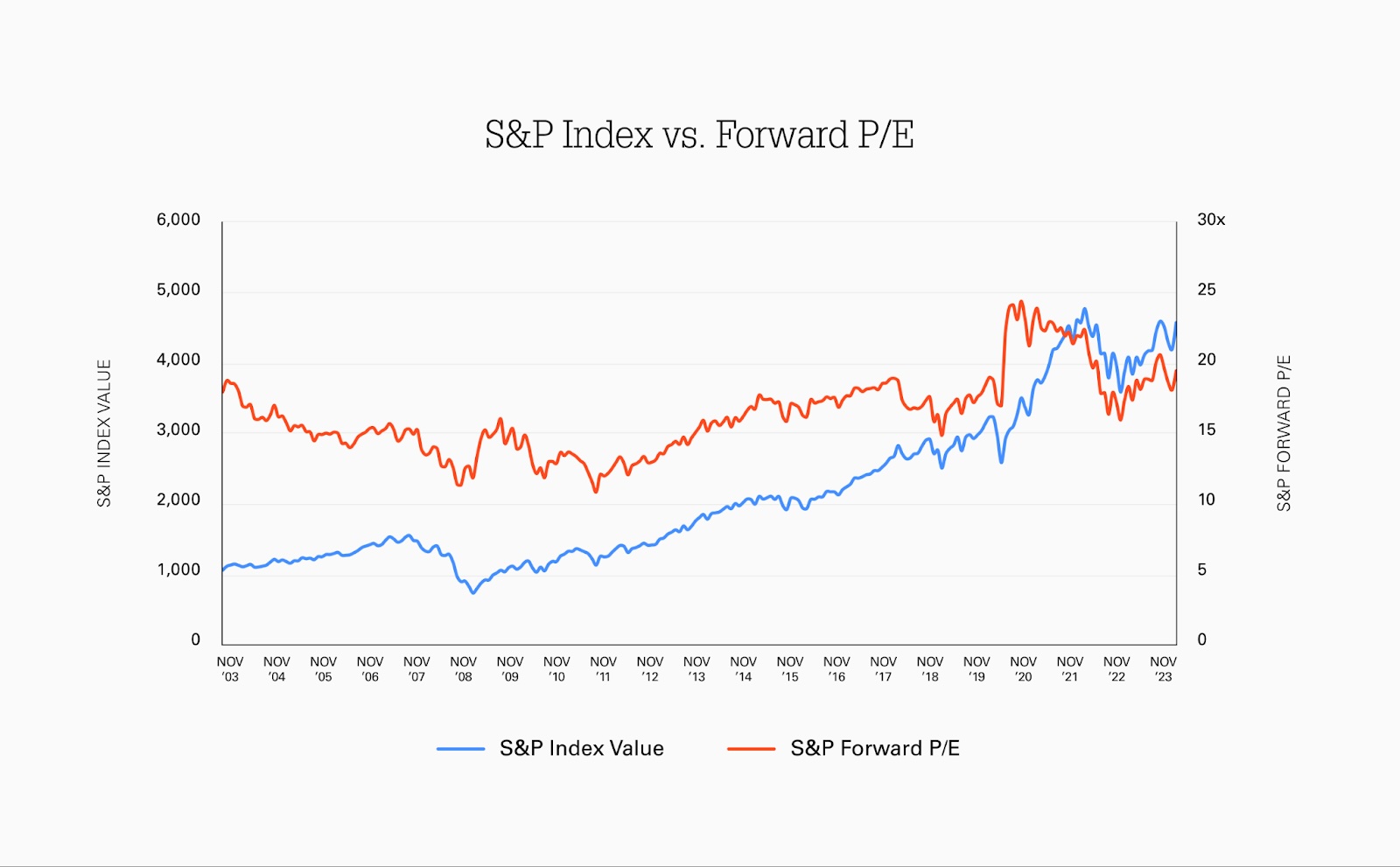

We are tight come near the two - year day of remembrance of an all - time highschool for the S&P in January 2022 . After a troubled 2022 and 2023 , the S&P call up in November and is now re - approaching the high , with valuation multiples also coming back due in part to the procession of the “ Magnificent Seven ” ( Alphabet , Amazon , Apple , Meta , Microsoft , Nvidia , and Tesla ) , as well as investor optimism around the potency for interest pace swing .

Given the whiplash , founders , operators , investor , and psychoanalyst likewise are leave wondering how to think through rating in anticipation of 2024 .

Over the years , there has been some widely praise and well - researched classic literature on rating , but these pathfinder can be hundreds ( or M ) of varlet , often leave readers overwhelmed .

With that in psyche , here are three virtual observations on rating for founder :

Interest rates govern public and private company valuations

gamey - performance coach recommend that guest “ see the controllables . ” Unfortunately , interest rates are not one of those controllables .

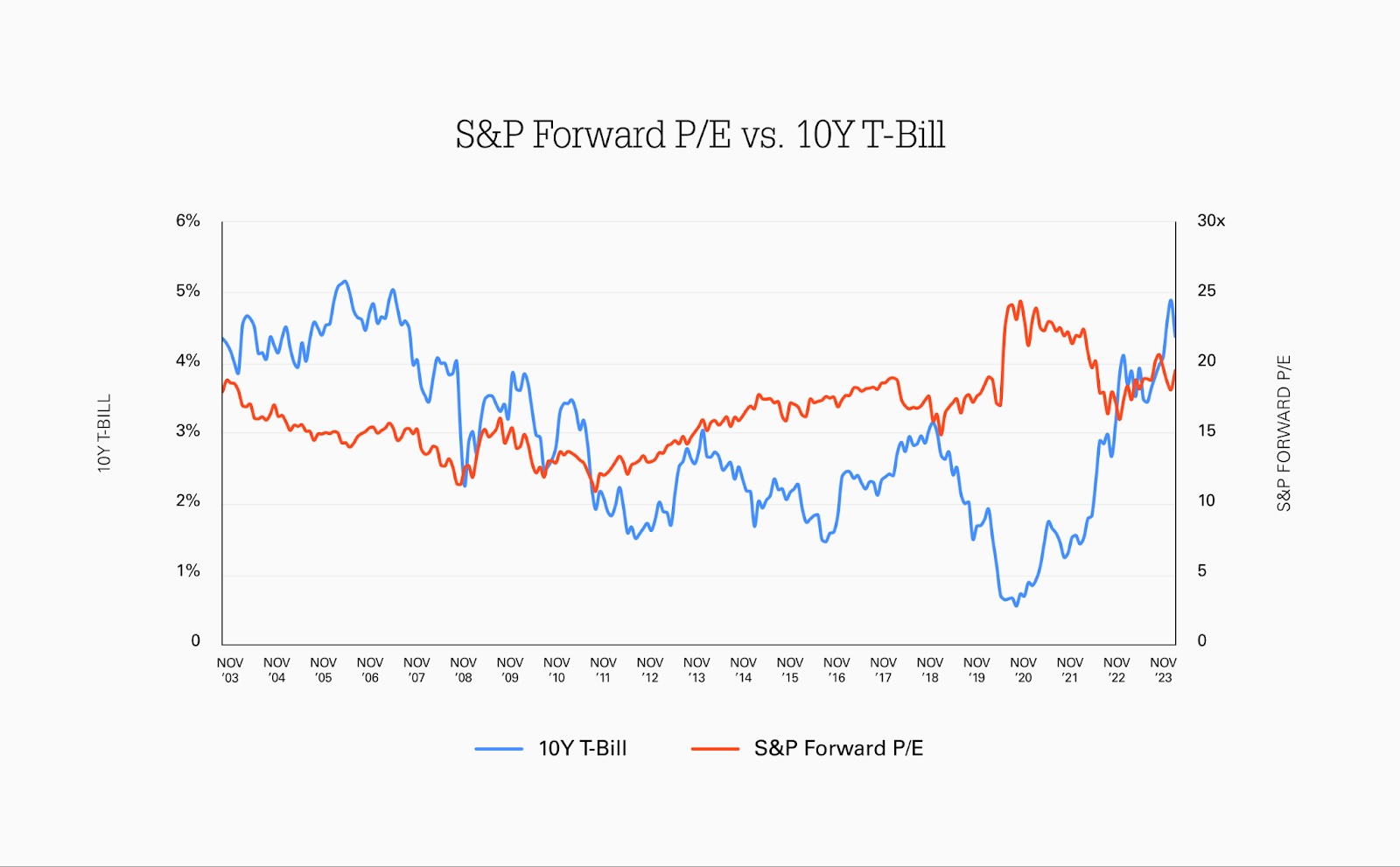

The Federal Reserve sets pecuniary policy as a way to attain low and stable inflation in the toll of good and services . When the Fed increases rate , it becomes more attractive for mortal to save rather than spend . The same is true for investors . If it ’s more advantageous to invest in risk of infection - free governance bonds , investor await higher return to endue in risk - bearing stocks .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

When it comes to valuation , the public market typically talks over metre about multiple of lucre , meaning net income or profit . For instance , a terms - to - earnings ( P / E ) multiple of 20 mean value that a company with $ 1 of pay per portion is valued at $ 20 . A 20x phosphorus / east multiple implies a 5 % net profit yield ( 1/20 ) . If a company does not yet have net income , analysts will refer to other placeholder for pay such as revenue , gross profits , or EBITDA .

When interest rates increase , multiples minify because investors demand a higher yield to invest in equities rather than bonds . We can see this by plotting the 10Y Treasury bill rate against the S&P forward P / E multiple .

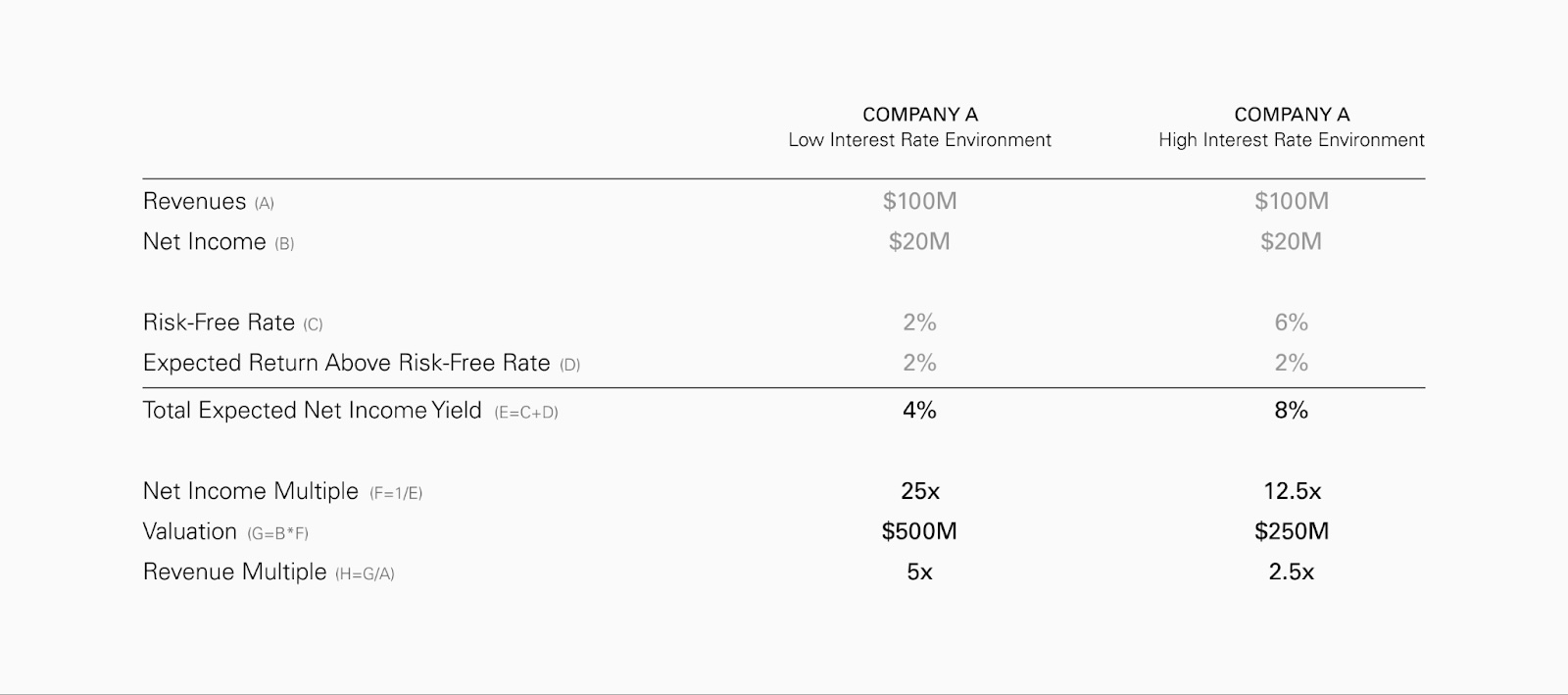

It ’s not always visceral , but a small-scale modification in interest charge per unit can greatly impact valuation .

Take an illustrative company make $ 100 of revenues and $ 20 of net income . In a 2 % interest charge per unit environment , an investor expecting to pull in a 4 % final income proceeds ( the danger - free charge per unit plus a bit spare to compensate for peril ) might value the society at $ 500 , or 5x revenues . In a 6 % interestingness charge per unit environment , an investor expecting to have an 8 % final income yield might esteem that same caller at $ 250 , or 2.5x revenues .

When interest rate vary course , valuation can change over chop-chop as shares of public company are traded daily with cost impacted by supply and requirement . When public market valuations are impacted for a prolonged period , private market valuations typically follow . As a result , movements in interest rate cascade throughout the Das Kapital markets .

While it ’s not potential for startup founding father to influence interest rates , there are other controllables regardless of whether interest rates are high or modest .

Focus on durable, high-quality revenue growth

Though the market talks about valuation in terms of multiples of lucre or revenues , these multiple are shorthand for a discounted cash flow analysis , which enounce that a company should be value at the center of its next earnings discounted back to the present twenty-four hour period .

In the early stages , proving intersection - market fit is critical . At the growth stage , durable , high - quality revenue development is what will ensure a strong evaluation .

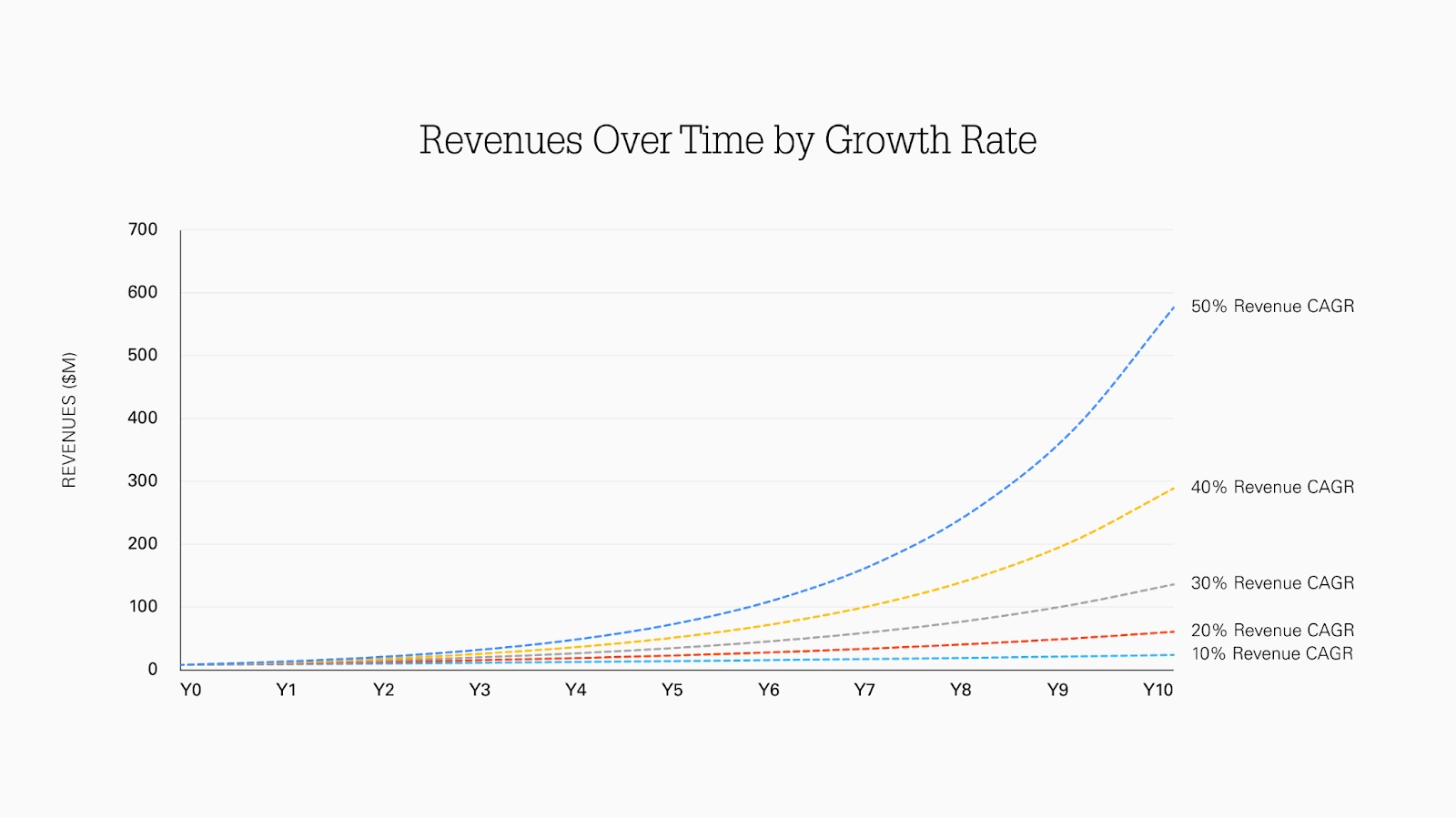

Some have referred to compounding as the “ 8th wonder of the world , ” and it ’s no surprise why . Take two companies starting at $ 10 million of revenues . The one that grows at a 50 % rate ( Company A ) will terminate up at over $ 250 million in eight year , whereas the one that grows at 30 % per year ( Company B ) will terminate up at roughly $ 80 million during the same fourth dimension point . The longer you go the sentence frame , the farther the gap let out :

society A should have a higher valuation today than Company B even though they are both at $ 10 million of gross , acquire they will have roughly standardized margin anatomical structure . Companies that are able to durably compound receipts over a long period of time mathematically should have higher valuations today than counterparts that ca n’t .

During tumultuous macro surroundings , it ’s important to home in on the micro and ask simple questions on durability of your taxation growth :

These attributes will eventually flow through to valuation in the fullness of time .

Valuation is driven by sentiment in the short-term and fundamentals in the long-term

In the light - term , valuation is lay by supply and demand for shares . In the public markets , prices can waver wildly , depend on die hard market persuasion that day or even that time of day . While private company shares are not trade daily , round are priced based on sentiment about future growth .

In the long - term , companies must have potent fundamentals to maintain premium valuations . Beyond durable revenue growth , this mean restrain high returns on invested Washington .

eatery chains offer a skilful analogy . A local burger joint with 10 locations will be treasure much gamey today if investors trust it has the potential to expand to 100 locations over time , with attractive returns to open each new location . In the unretentive - term , the evaluation is define by sentiment or expectations about the future , but in the long - terminus , the chain of mountains will have to make upright on its elaboration plan , or the evaluation multiple could cut meaningfully .

engineering science troupe act similarly . To maintain attractive multiple , they must grow and with secure rates of return on their internal investments . B2C tech company should be able to predictably adopt client cohort that bear similarly over time , with clearly defined and attractive return on invested capital , whereas B2B tech companionship should be capable to invest in rent incremental salespeople who bring in fresh customers .

Companies compounding revenues at a in high spirits rate and with stiff returns on invested capital lean to earn above - market valuations even during mellow - interest - charge per unit environs .

In any interest charge per unit surround , it ’s substantive to extend your time horizon and focus on foresightful - terminal figure note value cosmos as opposed to short - condition wins . Your company ’s terminal emergence rate , margin structure , salary potential , and return on invested majuscule will drive cardinal valuation over time through macroeconomic cycles . During times of precariousness , field of study , prioritization , and patience are cardinal .