Topics

belated

AI

Amazon

Image Credits:red_moon_rise(opens in a new window)/ Getty Images

Apps

Biotech & Health

Climate

Image Credits:red_moon_rise(opens in a new window)/ Getty Images

Cloud Computing

commercialism

Crypto

Image Credits:OpenView

Enterprise

EVs

Fintech

fundraise

widget

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

blank

Startups

TikTok

Transportation

speculation

More from TechCrunch

issue

Startup Battlefield

StrictlyVC

Podcasts

video recording

Partner Content

TechCrunch Brand Studio

Crunchboard

meet Us

It ’s been a week of mixed results for the software technology world : GitLab , Box , Yext and Asana cover their third - one-quarter effect in the past few days , and not all of them did well .

GitLab is the well-defined winner of the hebdomad . The company pound expectations for both tax revenue and profit , and send itsfirst adjusted operating profit since its initial public offering . Investors were understandably very proud of with the company ’s revenue rise 32 % , gross margin of 90 % , and nett retention of 128 % : GitLab ’s mart detonating equipment increased by almost a billion buck to $ 9.18 billion the twenty-four hours after its Q3 outcome , perYCharts .

The Exchange explores inauguration , markets and money .

Other computer software companies have not had similar amounts of fun . Box ’s share are down 8.6 % after it missedanalysts ’ estimate for revenue in the third quarterand count on modest revenue increment in its next fiscal class ; Asana reportedbetter - than - expected gross and gain in Q3 , but its portion are down more than 13 % due to concerns over its revenue growth prognosis . And Yext ’s stock took body blows this morning , plummeting more than 20 % after the ship’s company neglect analysts ’ expectation for revenue in Q3 andcut its gross forecast for the rest of its current financial year .

The picture that emerges is one of contrasts : Some technical school companies are doing well , but there ’s still a slew of pain in the market .

The unspoilt intelligence is that at least through last hebdomad , aggregated software program earnings datashowed an uptickin average last - new annual go back gross ( ARR ) growth , measured on a year - over - twelvemonth basis . After pass below zero for four quarters , median final - new ARR growth is back in the black , picking up by 3 % , according to Altimeter investor Jamin Ball . That ’s not much , but it does underscore why there ’s respectable reason to carry calendar 2024 to beslightly less unmanageable for software companies .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

But some good vibraphone are not enough to shelter the short - term value of these software companies . After all , they have scaled , serve enterprisingness customer , built sophisticated sale teams , and are now bid AI - have-to doe with features to tempt young vendee and retain prior accounts . You would think they would be doing better than they are , yield the economy ispretty strong in some ways , or that they would be able-bodied to raise price and better defend their growth rate .

This chair us to a query : Why is business enterprise software trading so inexpensively ? Or , put another way , is business software package dump ?

CAC, payback and perfect competition

The SaaS business model is great on paper . It give gamey - margin recur gross that has a disposition to lucubrate over metre provide economic conditions are fair . However , SaaS is not perfect : It consumes mountains of hard currency upfront to shoot down accounts that then make up back those expenses over time . This think of that even healthy SaaS company can stay pretty darn unprofitable for a very long clip .

There ’s a fashion out of the problem , however : Just charge more . Higher prices would make a company ’s sales travail more efficient in term of their spend - reward proportion ( CAC / LTV , if you want ) . And high prices would also deoxidise the impact of immediate payment disbursal to overcompensate sale toll , as they would be more quickly repaid .

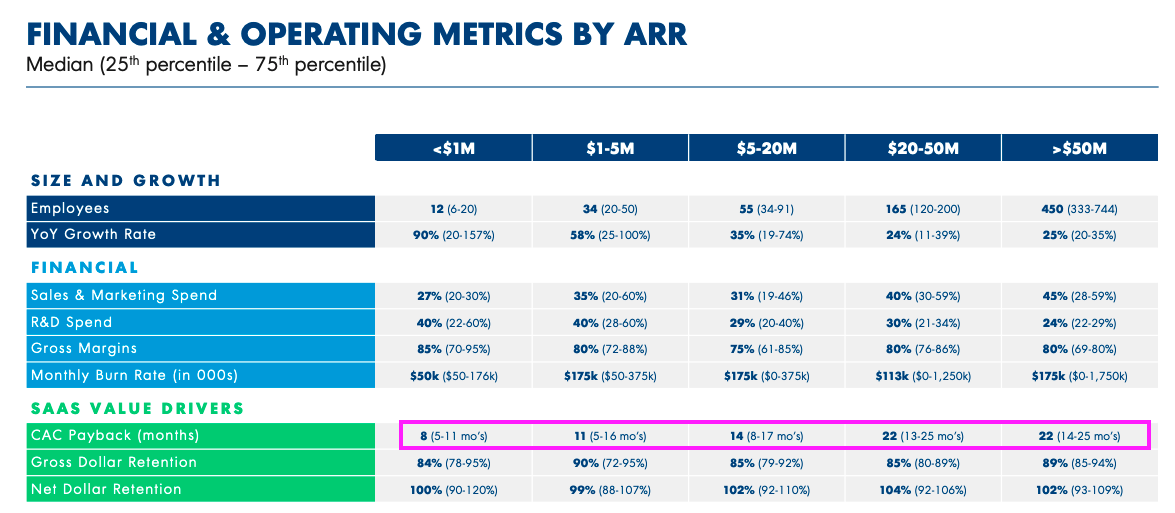

Here ’s a merriment enquiry : What ’s agoodcustomer acquisition monetary value ( CAC ) payback period ? If you are retrieve in terms of a few months or quarter , you ’re way off . find the highlighted discussion section in this table fromOpenView ’s 2023 SaaS system of measurement story :

As a software company scales , it can takenearly two yearsto take in back just one customer ’s acquisition cost . OpenView ’s data here is not spurious . As of last Friday , the software companies with the superlative forward tax income multiple were Snowflake , MongoDB and Cloudflare . Altimeter ’s Ballcalculatestheir gross - gross profit margin adjusted CAC payback full point to be 26 months , 13 month and 21 months , respectively .

So why do n’t software companies raise prices to both defend ( or enhance ! ) their outgrowth rates and to make the economics of their gross revenue framework more efficient ? A few reason do to mind :

A stress on longsighted - full term cash period : Software companies have historically bask positivistic net - retention rates , so they may be more focused on landing customers no matter the cost as long as they can grow that account over time . late trends in net holding , however , make this stratagem less sure than it was in years past .

Norms : Software is expected to cost a small fraction of the value that it provides . A well example of this is GitHub Copilot , whichcostsabout $ 10 per month for an person and $ 49 per calendar month for a full enterprise behind . ZipRecruiterreportsthat the average annual pay for a computer software developer isjust under $ 112,000 per year . At most , you could drop half a percent of a developer ’s salary by giving them access to cutting - edge AI tooling that will help them code . That ’s bonkers , but is n’t in reality that shocking . When Microsoft announced that Microsoft 365 ’s AI add - ons would be price at $ 30 per calendar month , investor werestoked . Again , compared to the salaries of the people at the keyboards in query , these be aretiny .

contention : I think this is the real issue . Thanks to ample contender ( big for customers and consumers ! ) , software system company do n’t have much flexibleness to increase their pricing . Box , for example , has built a mess of new tooling with AI capabilities but is struggling to grow not because it is failing to provide value , but because its customers have so many other alternative .

In fact , Big Tech companies ’ ability to have a play in every technology niche is probablyweighing downsoftware pricing . Google does n’t need to eat off its on-line memory fees , so smaller player who earn their bread and their butter from selling that are stuck with anchored price thanks to Mountain View , in our little thought experiment .

Another means to say “ software company lack price purchase due to competition ” is : Most software is fighting in a market where the moral force of stark rivalry come into maneuver .

Investopediadefines perfect competition as follows :

Under perfect competition , there are many buyer and seller , and prices excogitate supplying and requirement . ship’s company earn just enough gain to stay in business and no more . If they were to earn spare lucre , other companies would enter the market and drive profits down .

That explain the retentive CAC vengeance time period , high - cash expenditure , and maturation rate that are more drive by macro atmospheric condition than the quality of the production sold .

So , yes , business softwareislikely too cheap , butonly in area where anyone can code up a workable rival . From that perspective , the only way to ensure that your software company kick maximum cigaret is to make certain that it has a modified pool of competition so you could annul pricing pressure .

That ’s clear enough for startups : make something that no one else can , or serve a market place that no one else is . But for public package companies with lots of in - market alternatives , that ’s not exceedingly helpful .

Of course , it ’s not impossible . GitLab is doing just fine despite compete with GitHub , which is have by Microsoft . But after watch software company shin to reignite increment twenty-five percent after quarterdespite some positive signals , I have to wonder if the middling rate of software package growth in assorted economical consideration is lower than folks gestate .

Not that such a situation is a bad one for end users and customer : utter rivalry profligate much of the profit from business operation , result in consumer nimiety .

Still , pour one out for Box et al . who are give a difficult clock time growing despite doing the hard work required to vie .