Topics

late

AI

Amazon

Image Credits:LumiNola/Getty Images (Image has been modified)

Apps

Biotech & Health

Climate

Image Credits:LumiNola/Getty Images (Image has been modified)

Cloud Computing

Commerce

Crypto

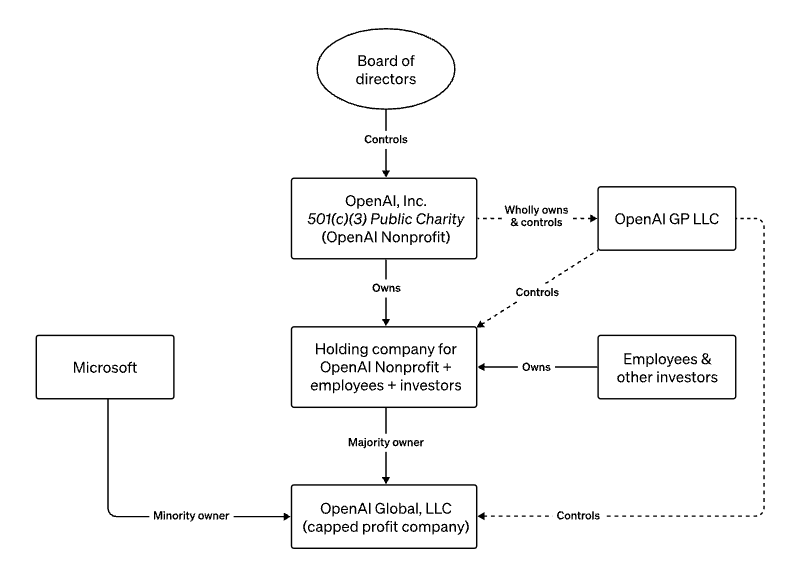

How OpenAI described its operating structure in the pre-turmoil days.Image Credits:OpenAI

enterprisingness

EVs

Fintech

fundraise

Gadgets

back

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

Startups

TikTok

Transportation

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

adjoin Us

The knock-on effects could be substantial

OpenAI was never quite like other generative AI inauguration — or other startup point , for that matter . Its governance structure is unique andwhat at last precede to the sharp ouster of CEO Sam Altman on Friday .

Even after ittransitioned from a nonprofit organization to a “ capped - profit ” company in 2019 , OpenAI retain an strange bodily structure that lay out in no unsealed terms what investors could — and could n’t — expect from the inauguration ’s leaders .

For example , OpenAI backers ’ returns are set to 100x of a first - round investing . That means that if an investor place in $ 1 , for example , they ’re cap to $ 100 in total repay profit .

OpenAI investor also agree — in possibility , at least — to abide by the charge of the non-profit-making guide on OpenAI ’s commercial-grade endeavors . That delegacy is to attain artificial general intelligence ( AGI ) , or AI that can “ outperform human being at most economically valuable work ” — but not needfully generating a profit while or after attaining it . Determining exactly when OpenAI has attain AGI is at the control panel ’s exclusive discretion , and this AGI — whatever mannequin it takes — is exempt from the commercial licensing agreements OpenAI has in blank space with its current customer .

OpenAI ’s double , foreign mission - driven structure was aspirational , to say the least , inspired byeffective altruismand designate to clearly delineate the company ’s net - making efforts from its more ambitious , humanistic goal . But investor did n’t weigh on the board exercising its power in the way it did . Neither did many employee , it seems .

The board was well within its right to give notice Altman , who held a table seat but no fairness in OpenAI besides a minuscule investiture through a Y Combinator fund . ( Altman was the accelerator ’s former chairwoman . ) sure enough , investors could n’t contend , as none had board derriere . Until the departures of Altman andGreg Brockman , OpenAI ’s former President of the United States and board chairwoman , the board was compose of three outside directors and three OpenAI executive , the remain being Quora CEO Adam D’Angelo , OpenAI master scientist Ilya Sutskever , tech entrepreneur Tasha McCauley , and Helen Toner , the director of strategy at Georgetown University ’s Center for Security and Emerging Technology .

You might assume that investor will think twice about getting involve with such a government activity structure going fore and treat the OpenAI fallout as a cautionary tale , and you would n’t be incorrect . OpenAI ’s backers are certainly displeased . Microsoft’sSatya Nadella wasreportedly“furious ” to watch of Altman ’s loss “ moment ” after it take place , and some key venture capital backers of OpenAI are say to be contemplating a lawsuit against the board .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

TechCrunch+ talk with several VCs and faculty member who predict that the roast - on upshot will be both hearty and far - reaching .

Umesh Padval , married person at Thomvest Ventures , which invest in OpenAI contender Cohere , implied that OpenAI was structure such that “ misalignment ” between the non-profit-making board and the quietus of the company was almost inevitable .

“ consanguine to the model embraced by OpenAI , the circuit board makeup can mirror that of for - earnings entities , ” he separate TechCrunch+ via email . “ However , the accent shifts toward ensuring that board members are not only highly experienced but also maintain a strong signified of independence . Although entities can strike a effective balance with plug-in phallus , without a clear define mission agreed upon by both founder and the board , as observed in recent events at OpenAI , it can lead to misalignment . ”

Some investor may even rethink the “ circuit board manikin ” entirely . “ I am 100 % pro - governance , but not always 100 % pro - board . . . can we do better ? ” said Sheila Gulati , Centennial State - beginner and managing theater director at Tola Capital . “ What are the protections that investor who are n’t on the card can command and what of other stakeholders like employees ? AI needs to be a harmonic combination of skill and business . Researchers are the artificer and should as a radical not be dismissed from leadership positions , including board . ”

lend Christian Noske , a spouse at NGP capital , on a more or less more measured distinction : “ Most boards are unfortunately detracting value — as we ’ve seen now in the situation with OpenAi . Nonstandard governance structures are always a vexation for investors , but they ’re being accepted in hot deals and marketplace environments . Overall , OpenAI ’s establishment body structure is not ordinate with the nature of venture upper-case letter as we recognize it . At the same time , if we search at the other end of the spectrum , Robert Bosch is over 127 years previous and has a moderately similar establishment structure to OpenAI — and it ’s served them well . Savvy investors treat every business concern other than and know not to levy thing on them . ”

We ask Jason Schloetzer , an associate prof at Georgetown University ’s McDonough School of Business ( yes , the same Georgetown that pays Toner ’s salary ) , whether what happen at OpenAI will shake confidence in researcher- or ethicist - result AI companies . Will investors need more commercial - orientate folks heading companies ’ boards if they ’re to indue ?

Schloetzer does n’t anticipate much will alter in this section , positing that researchers and value orientation experts will stay to sit next to capital providers to round out boardroom discussions . But he said he expects investor ’ appetite for non-profit-making - governance - associate riskspecificallyto diminish .

“ I suspect the initial investors went along with [ OpenAI ’s ] non-profit-making body structure to reach admittance to the investment funds opportunity , ” Schloetzer said . “ The thought could ’ve been that if these investments wear yield — which they did beyond initial beliefs — the nonprofit structure would be capable to flex or even completely change . That did n’t bechance ; the original board stuck to the original beliefs , which they have every right to do . And this is the result : A split between profit - oriented and mission and safety - point motivations . In the future , capital will flow to this sort of mission and safety machine - oriented motive only if it believes in the charge and not if it believes the mission can eventually be changed . ”

Could OpenAI glum investors ’ opinion on boards altogether ? Perhaps . Jo - Ellen Pozner , an associate professor of direction at the Leavey School of Business at Santa Clara University , thinks so . And , she says , it ’ll be to investors ’ detriment .

“ I think investors may become more wary of investing in firms with strong boards , which is really to their disadvantage , ” she told TechCrunch+ in an email . “ Boards of directors are in place to put a rein on managerial doings . If it ’s the case that Altman was preventing the display board from enacting right monitoring in pursuit of creditworthy AI development , it may have been right to didder things up , even if its implementation — from timing to stakeholder employment to public messaging — was frightening . If the lesson from OpenAI is that hard governance can destroy companies , we ’re all in trouble ; serious fellowship need good administration to thrive and meaningful stakeholder responsibility can only be achieved through the decision of government . ”

Pozner walk out somewhat of a bright tonicity , though , making the case that not all investors are pure profit maximizers or shareholder - time value maximizers , and that these investor still require experts , researchers and ethics - minded players to run organizations .

“ Investors with profit - maximizing motives will always want commercially apt folks with their hands on the rack , ” she say . “ [ But ] good governance make serious line as a general rule , and perhaps even more so when so much is at stakes . ”

It might not be long before OpenAI puts that theory to the test .