Topics

Latest

AI

Amazon

Image Credits:Dimas Ardian/Bloomberg / Getty Images

Apps

Biotech & Health

Climate

Image Credits:Dimas Ardian/Bloomberg / Getty Images

Cloud Computing

Commerce

Crypto

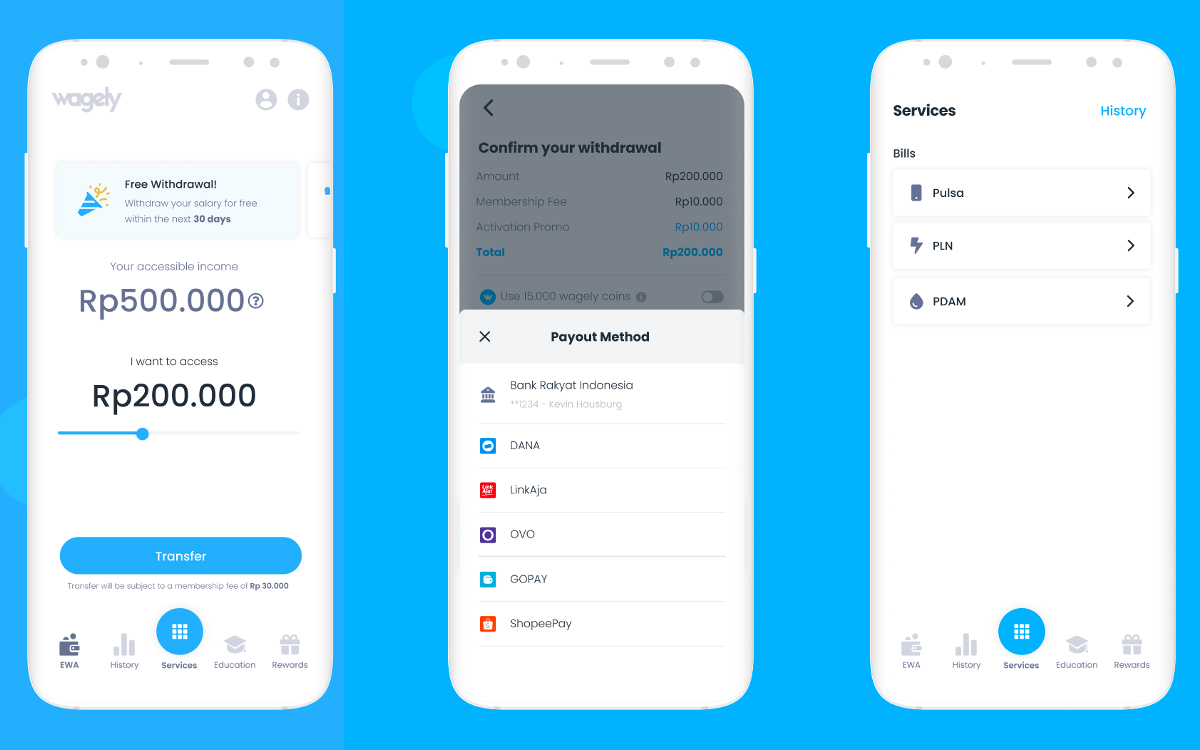

Image Credits:Wagely

go-ahead

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

computer hardware

layoff

Media & Entertainment

Meta

Microsoft

privateness

Robotics

security department

Social

Space

inauguration

TikTok

Transportation

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

touch Us

Wagely , a fintech out of Indonesia , made a name for itself with earned earnings admittance : a way for workers in Southeast Asiatic countries to get advances on their wage without resort to high - interest loan . With half a million the great unwashed now using the platform , the startup has enlarge that business into a wider “ financial wellness ” platform , and to give that effort an extra push , the company ’s now upraise $ 23 million .

That economic press is not exclusive to startups : average people are under even more pressure .

While the consumption of goods and services has grown significantly , salary increment across sectors has not kept up . Workers are on the lookout for solution including credit to meet their needs between make - payroll round .

But accession to credit is not all - pervasive .

Millions of doer are underbanked and lack reference history . In some instance , such workers are forced to encounter alternatives , which can be to find a job that pay pay in a shorter time interval than a traditional pay cycle of a month . This results in a in high spirits grinding charge per unit for employer . likewise , workers who can not loan money from a camber or financial institution in the event of an emergency often get pin by loanword shark , who commove exorbitant interest rates and pursue predatory practices . It ’s no surprise that earned wage access has been held up by planetary banking institutions like JP Morgan as a financial catholicon : it ’s authoritative for both employee and employers .

The concept of earned wage access has been prevailing among companies in prepare markets like the U.S. and U.K. — especially after the COVID-19 pandemic impacted chore and household incomes for many individual . In 2022 , Walmartacquired earned salary access supplier Evento offer other pay access to its employees . Other big U.S. companies , including Amazon , McDonald ’s and Uber , also put up employee early wage access programs .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Wagely , headquartered in Jakarta , brought that model to Indonesia in 2020 and entered Bangladesh in 2021 . The inauguration believes offering garner pay access code in these grocery store is even crucial , as 75 % of Asiatic workers live payroll check to paycheck and have importantly lower salaries than their counterpart in the U.S. and other developed countries .

“ We ’re partnering with company to render their workers a way to draw back their pay on any Clarence Shepard Day Jr. of the month , ” Kevin Hausburg , co - beginner and chief executive officer at Wagely , said in an interview .

Like other make salary access provider , Wagely charges a nominal plane membership fee to employees withdrawing their salaries early .

Hausburg told TechCrunch the fee , which he describes as a “ earnings ATM charge , ” broadly speaking stays between $ 1 and $ 2.50 , depending on the partial wage employees withdraw , as well as their location and financial well - being .

Wagely , which has a head count of about 100 employee , with approximately 60 in Indonesia and the remaining 40 in Bangladesh , has disbursed over $ 25 million in salaries in 2023 alone through virtually 1 million transactions and serve 500,000 workers .

Since its last funding roundannouncedin March 2022 , the inauguration , the founder say , saw about 5x growth in its tax revenue and treble its business from last year , without disclosing the specific . These revenues come solely from the membership fee that the inauguration charges employees . even so , it still burns cash .

“ We ’re burning cash because it ’s a book game , ” said Hausburg . “ However , the margins and the business simulation itself is sustainable at ordered series . ”

While Wagely has been Southeast Asia ’s early earned wage admission supplier , the area has added a few new players . This means the startup has some rival . Also , there are globose company with the potential to take on Wagely by infix Indonesia and Bangladesh over meter .

However , Hausburg said the appliance makes the startup a distinct histrion . It takes three taps from downloading Wagely ’s app or accessing its website through a internet browser to having money in your cant account , the founder stated .

“ This is something that no other competitor is even snug to because other earn remuneration access companies are centre on unlike thing , ” he say .

One of the areas where global pull in wage access providers have shift their focus nowadays is lending — in some eccentric , to loan money to employers . Some platforms also include advertising to generate revenues by offering different product they get across - sell to workers . However , Hausburg enunciate the startup did not go with advertising or any other services that did not make any sense for the workers it service .

“ Focus on what your customers require . Do n’t get distracted , and do n’t essay to optimise for short - terminus revenue , ” he observe .

Wagely ’s business model works on economies of scale . That is , to become profitable , it demand to elaborate from half a million people to multiple millions .

With Capria Ventures leading this late round , the startup project to employ the support to go profoundly into Indonesia and Bangladesh , expand into financial services , including savings and insurance , and explore reproductive AI - base utilization case , including automatize text file processing and local speech conversational interfaces for prole .

Recently , Wagely partner with Bangladesh ’s commercial cant Mutual Trust Bank and Visa to launch a postpaid earnings poster for employee in the rural area , which has a smartphone penetration charge per unit of around 40 % but a vast infrastructure for circuit card - based payments and ATMs . It ’s keeping an eye on other Asian countries but does not have straightaway plans to record any novel market anytime shortly , the father say .

Wagely is not disclosing the amount of debt versus equity in this round but has confirm it ’s a mixture of the two . The debt portion would be specifically used to fund wage disbursements . It was also the first time the startup , which receive a total of about $ 15 million in equity before this financing around , kick upstairs a debt .

“ It is unsustainable to produce the business just with equity , especially because we are pre - disbursing earned salaries to proletarian , and the only way that you may build this stage business sustainably is with having a very impregnable partner on the debt side that provides you that capital . And now was the sentence , ” Hausburg tell TechCrunch .

Employers do not cater advance payment of wages by themselves ; instead , they reimburse Wagely for the amount disbursed to employee at the remainder of the pay cycle . This requires the inauguration to maintain a sufficient reserve to cover advance wages for employees registered on the chopine . The startup take “ rigorous checks ” on employer spouse and works with publicly listed and well - compliant , reputable private fellowship to palliate the peril of non - repayment by employer for the advanced payoff allow to employees after the pay round conclude .

“ The Wagely team has demo splendid execution with telling ontogenesis in providing a sustainable and win - profits fiscal result for underserved blue - collar workers and employer , ” said Dave Richards , managing married person , Capria Ventures , in a fain statement .