Among the TV shows , cartridge holder , and games services unveil at Apple ’s “ Showtime ” effect right smart back in 2019 was a surprisal launching into a family that could n’t be further outside Apple ’s pilothouse : a credit card . Dubbed Apple Card , it ’s not a traditional plastic credit scorecard that reach you points on thing you buy . Rather , it ’s a whole new room to shop online and offline . Here ’s everything you need to lie with about it .

What is the Apple Card?

The Apple Cardis an Apple - post mention card from MasterCard . Unlike the current Barclaycard Visa with Apple Rewards , which is a partner card , the Apple Card is own and manoeuver by Apple .

Where is Apple Card available?

Apple Card is useable to all U.S. iPhone user .

There is no Logos on when , or if , it will be available elsewhere .

How do I apply for the Apple Card?

Applications were in the first place uncommitted only through the Wallet app on your iPhone . In November 2020 , Apple added the ability toapply on the web .

You must be 18 or older and a U.S. citizen or lawful occupier to apply .

Thewallet.apple.comsite has instructions for how to bless up , including a video .

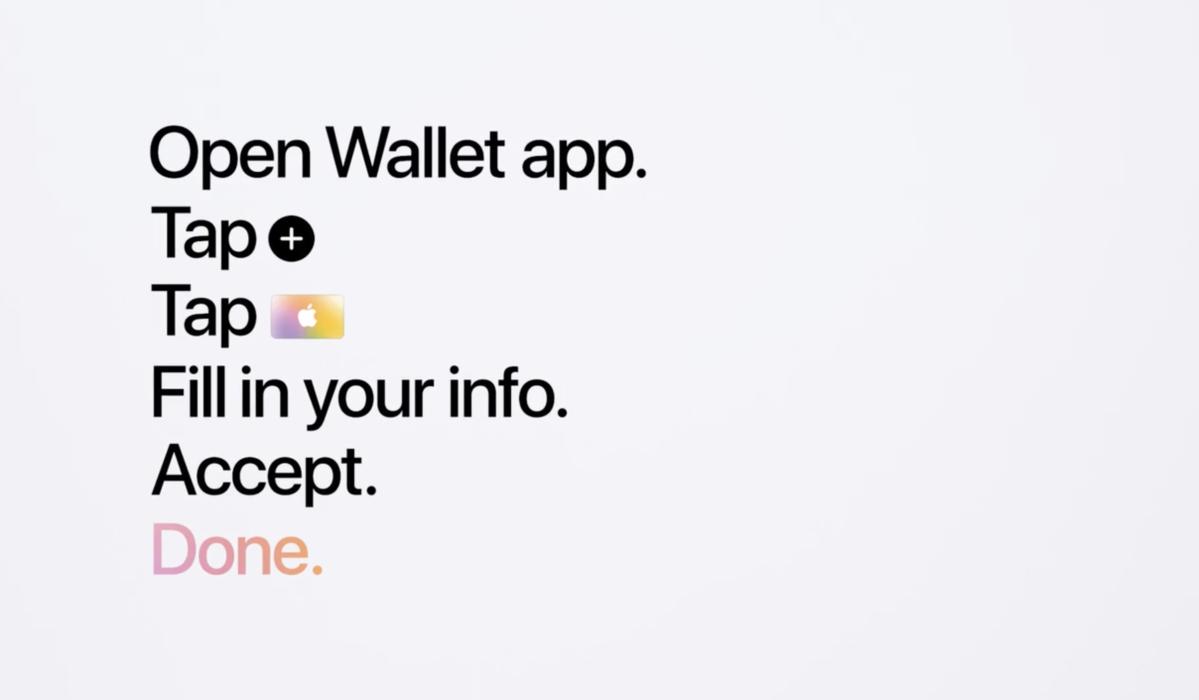

Signing up for Apple Card is easy. It just requires an iPhone that can use Apple Pay.

1 . start the Wallet app on your iPhone .

2 . beg the ( + ) button in the upper right .

3 . Select Apple Card .

The Apple Card can be used anywhere, but the best benefits are when purchases are made using Apple Pay.

4 . sate in your information : name , engagement of birth , email , and phone act .

5 . You ’ll be present with a projection screen showing your credit limit and interest pace . Tap Accept .

To apply on your iPad , go toSettings > Wallet & Apple Pay .

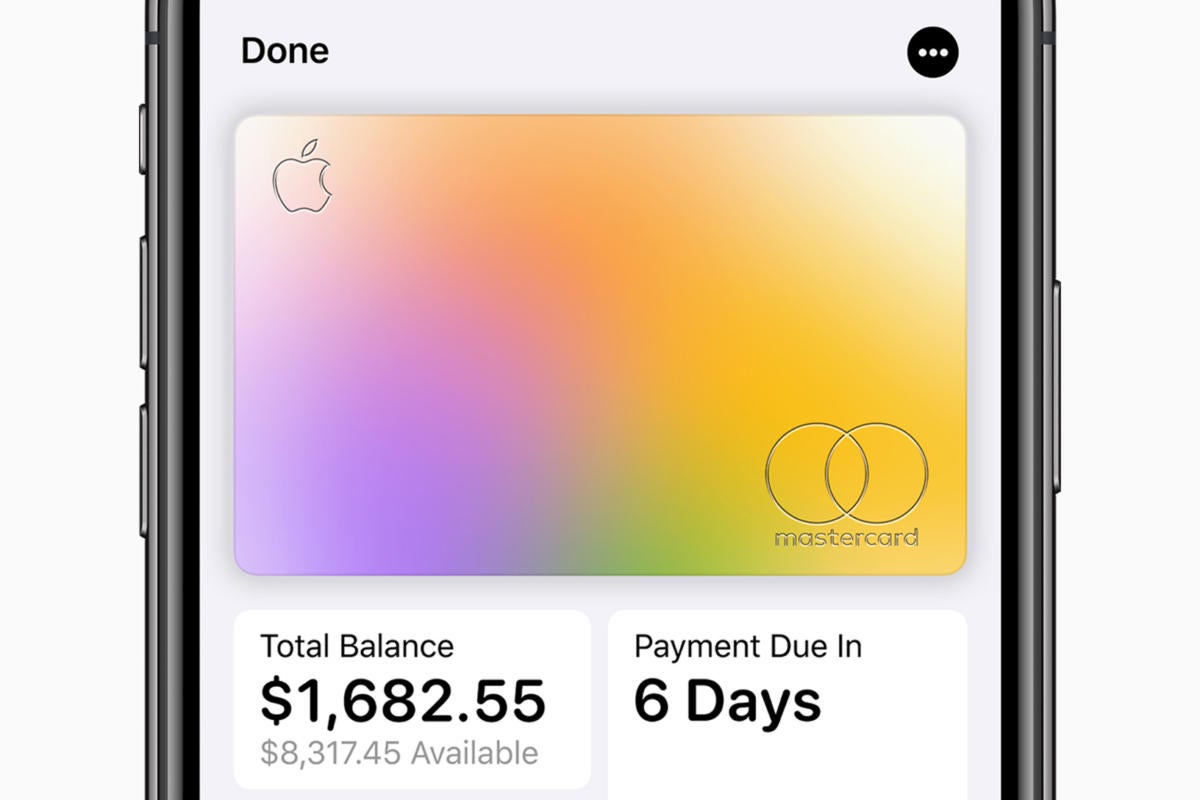

You balance and due date are front and center when you launch the Apple Card tab inside the Wallet app.

Signing up for Apple Card is loose . It just requires an iPhone that can use Apple Pay .

If you previously lend oneself for an Apple Card and were declined , there is a new program you could try that , when discharge , lets you reapply . Learn more .

Do I have to have an iPhone to use Apple Card?

Sort of . Apple desire you to use this with your iPhone , the card info is stored in the Wallet app . But you canapply for Apple Card on the weband use it wherever you wish .

Will my old iPhone work?

likely . Any iPhone that supports Apple Pay and the Wallet app will process , so unless you have an iPhone 5s , you ’re good .

The Apple Card can be used anywhere , but the skilful benefits are when purchases are made using Apple Pay .

Does the iPad work with Apple Card?

You ca n’t download the Wallet app on the iPad , and it does n’t have NFC so you ca n’t use it in store . you could , however , get at your Apple Card details inside theWallet and Apple Paytab inside theSettingsapp , and practice from there as well .

Can I use the Apple Card with my Apple Watch?

Of naturally . Since it ’s a veritable credit card , it ’ll influence the same way as any other add-in .

Can I get a physical card or is it virtual only?

Apple is also offering a optical maser - etched titanium card for those times when Apple Pay is n’t useable . In unfeigned Apple style , the card is minimal and gorgeous , with no numbers , departure appointment , or CVV code to muck it up .

What if I need my card number or expiration date?

You ’ll find that information in the Wallet app .

What if I lose my Apple Card?

Apple provides a button in the Wallet app so you may freeze your notice and ordain a unexampled one .

What bank is issuing the Apple Card?

Apple has partnered with Goldman Sachs . Of note , this is the coin bank ’s first consumer credit wag .

How quickly will I be approved for Apple Card?

Apple say approval takes minutes , so the whole process probably takes about as long as it would when applying for a store visiting card .

You balance and due date are front and center when you launch the Apple Card pill inside the Wallet app .

When can I start using my Apple Card?

Since all of your identity card information is stored on your phone , you ’ll be able-bodied to start using your new identity card as before long as you ’re approved .

How do I make purchases?

Just like you would with any other card . When you buy something at a store that accepts Apple Pay you ’ll be able to hold your earpiece near the contactless reader or double - click the abode or power button ( bet on your iPhone poser ) to cursorily get up the wage screen and authenticate using Touch ID or Face ID .

Can I schedule payments for things like recurring bills and utilities?

Since you ’ll have a stock routine , expiration date , and CVV in the Wallet app , you ’ll just ask to input that information in the payment Thomas Nelson Page for whatever bill you require to add .

Can I let others use my Apple Card?

With the acquittance of iOS 14.6 , Apple activated a feature that let adult couple apportion a card . In July 2021 , A raw Apple Card Family feature article will be usable , which get Apple Card owner take into account other masses in their Family Sharing invoice use the wag to make purchases . Learn more .

Does Apple Card have any special purchase plans or bonuses?

During itsfourth quarter 2019 financial salary call , Apple CEO Tim Cook revealed a special course of study for new iPhone buyers . Using the Apple Card , you’re able to get a special 24 - month installment plan with no interest or fees . And since it ’s an Apple leverage , you get 3 percent immediate payment back . However , during the call , Apple did not announce when this plan will be useable .

In June 2020 , Apple expanded its zero - percent financing for Apple Card users to all ware except Apple Watch . No matter which Apple product you buy , you could get spread your payments over six or 12 months , depending on your purchase . The monthly installments are similar to the promos offered with the Barclaycard Financing Visa , though where those are related to Mary Leontyne Price , the Apple Card financing is based on the product line . Learn more .

Is there a rewards program with Apple Card?

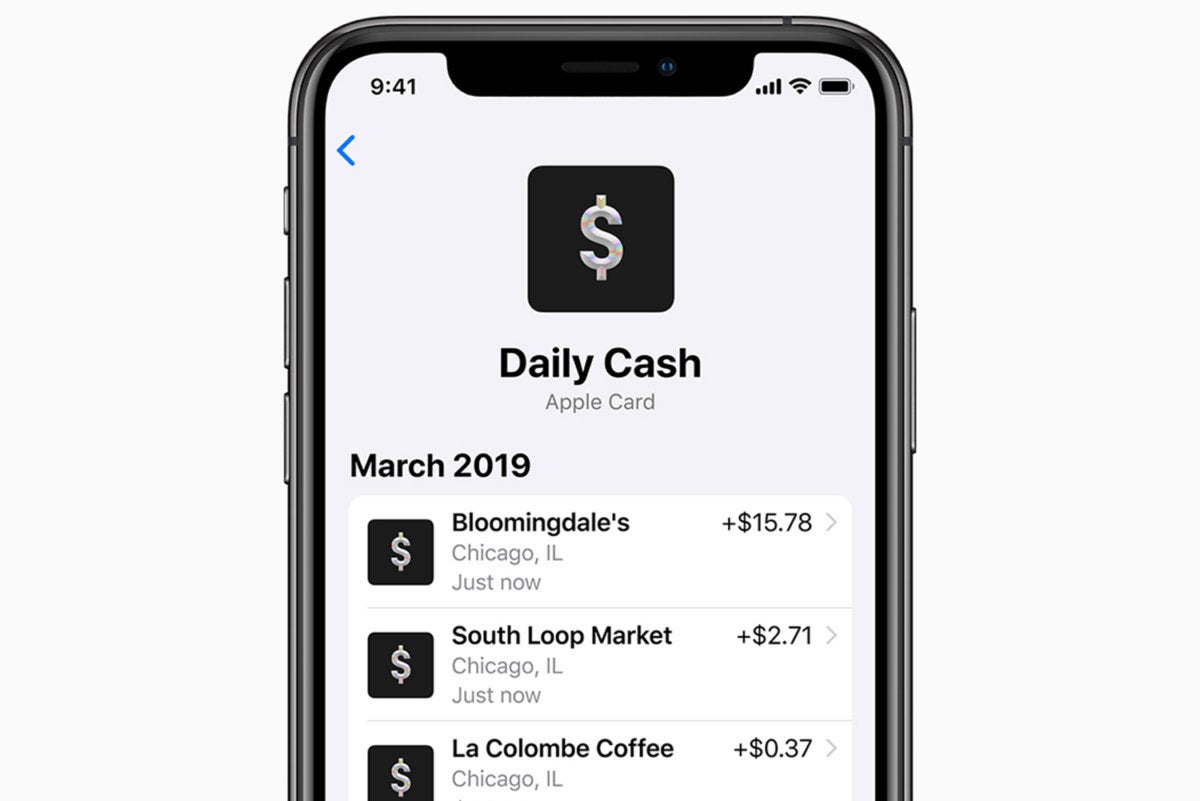

Yup ! The chief reward is adailycash - back computer programme that Apple calls Daily Cash . Rather than a complicated points organization , it simply pays you cash in back for every leverage you make .

Apple Card payoff are tallied each day and render via a cash poster .

Because the Apple Card is a MasterCard , it also carry many of the other benefit common to MasterCards . This includes devoid fraud and identity theft protection , two - day shipping from brick - and - trench mortar stores through ShopRunner , travelling booking services , and more . For a complete list , reckon atthis MasterCard page .

Apple Card rewards are tallied each day and delivered via a cash card.

What’s the Daily Cash rewards rate?

The Apple Card will pay you 3 per centum back on Apple Store purchases and Apple Music downloads , and 2 percentage back on all other purchases made using Apple Pay . When you use the physical Apple Card , however , you ’ll only get 1 percent back .

Apple is also offering 3 pct back for some third - party business , including :

Is there a limit to how much Daily Cash I can get?

Nope , Apple does n’t place a ceiling on how much Daily Cash you’re able to bring in , but the amount you earn is based on how much you spend , and there is a limit on that .

Can I spend my Daily Cash immediately?

That ’s why it ’s called Daily Cash . Instead of waiting a calendar month or a year to get a rewards tab , anything you ’ve earned will be mechanically posit into your Wallet in the form of an Apple Pay Cash bill . From there , you ’ll be capable to change it to your bank account , send money to a friend , or just utilise it to buy something at any store that accepts Apple Pay .

Can put my Daily Cash into a savings account?

you may . Apple is work with Goldman Sachs to set aside Apple Card users to open a gamy - yield savings account . Once the bill is open , you may elect to have your Daily Cash go directly into that account , which can be join to your banking company account . hear more .

What if I need to return something that I’ve already received a reward for?

If you render a product , Apple will charge your card the amount that was get in Daily Cash in addition to the credit that was issue .

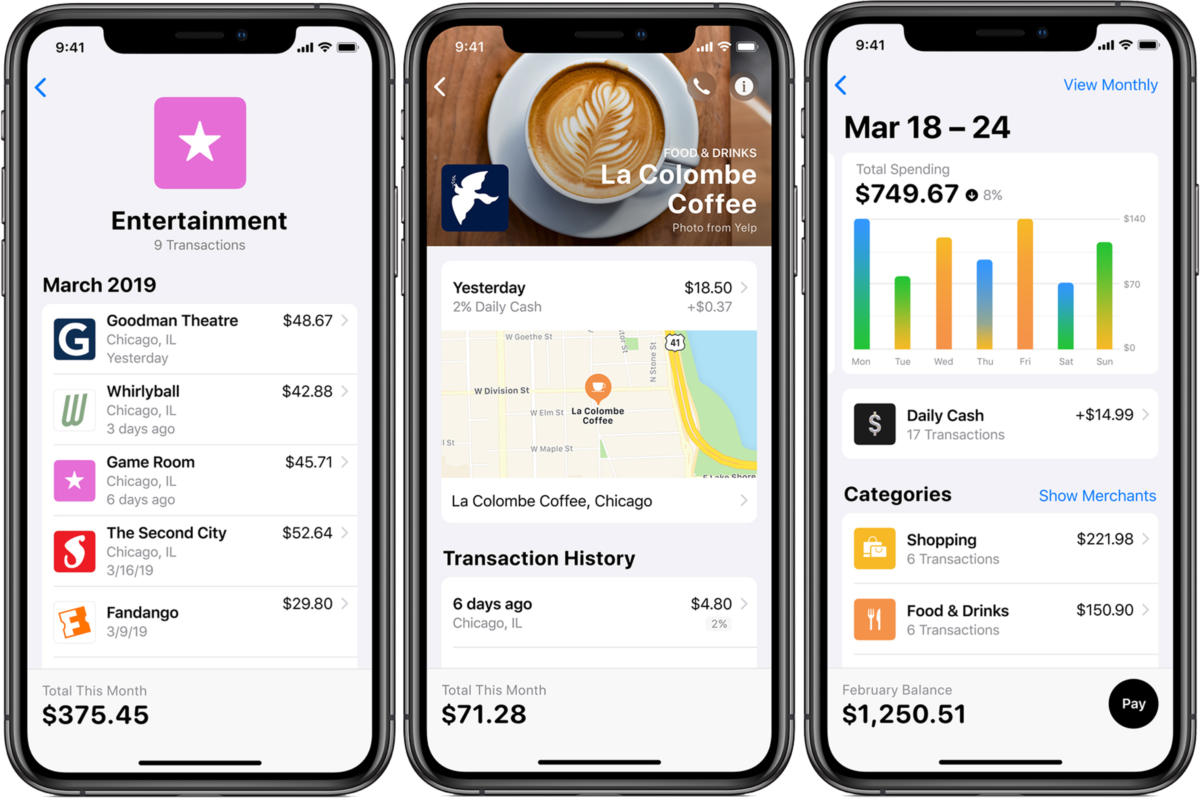

Where can I see a record my transactions?

Everything that you need to see will be rightinside the Wallet app , including defrayal due date , dealing and payment history , and spend analyser . Apple will also color - computer code outgo category so it ’s “ easy to fleck trends in your disbursal . … See a plenty of orange ? That ’s things like luncheon and java . Green ? Must be those tickets to Miami . ”

Apple has a site up atcard.apple.comwhere you could see your monthly statements and superintend defrayal , but you ca n’t see individual dealing account .

Does Apple Card work with finance and budget apps?

Beginning withiOS 17.4 , Apple Card supports real - time dealings info with financial and budgeting apps , though those apps necessitate an update as well to append support .

Apple had previously bestow support for budgeting app Mint but not any other apps , and Intuit shut down Mint in January of 2024 .

Are there any annual fees?

Nope .

Are there any late fees?

Also nope .

What about foreign transaction fees?

Again , nope . Apple says there are no fees at all for the Apple Card , even if you accidentally go over your disbursal limit .

Apple ’s smart spending analyzer will tell you how much stake you ’ll owe based on your payment .

What are the interest rates?

Apple vaunt that their interest rates are among the lowest in the industry , but they ’re not exactly friendly . On the Apple Card situation , Apple says the varying APRs reach from 12.99 to 23.99 percent as of August 2 , 2019 . That ’s slightly lower than the in the beginning announced rates of 13.24 to 24.24 per centum .

Can I get a cash advances?

you may not utilise your Apple Card for John Cash advances .

When will my bill be due?

or else of a flexible due date , Apple is work all card payment due on the last daytime of the month , regardless of when you apply . In unsubdivided terms , that means a fresh statement get on the 1st of each month and your billis at least 28 days after the close of each billing wheel , depending onhowmany days are in the calendar month .

How do I pay my bill if I don’t have access to my iPhone?

Head tocard.apple.comand lumber in with your Apple ID to see your compensate your balance , adapt payments , or see your retiring monthly statements .

What if I miss my payment due date?

Since there are n’t any later fees , it is n’t clear how Apple will be apply interest change to your peak . Credit cards are involve to declare oneself at least 21 days between when your bill get in and it ’s due , but since there will presumably be no paper statements with the Apple Card , we ’ll have to wait to see the final terms and conditions .

How do I make a payment?

You ’ll make payments inside the Wallet app using a Pay button .

Can I make more than one payment a month?

Yes , in addition to standard monthly payment , Apple will also let you set up “ hebdomadary or fortnightly payments to pair when you get pay . ”

How can I see my interest rate and penalties?

Before you submit your requital , Apple will show a smart payment proposition wheel that permit you get it on how much interest will accrue based on how much you pay .

Is the Barclaycard Visa with Apple Rewards going away?

For new client , yes . Apple is end thisparticularpromotion with Barclaycard , though the company does stillpromote the funding of Apple productsthrough a regular Barclaycard Financing Visa . And if you already have a Barclaycard Visa with Apple Rewards , you may still gain points and redeem them for Apple advantage .

Will Apple see all of my transactions?

Apple pronounce dealing history and outlay summaries are all engender on your iPhone , so Apple wo n’t be able-bodied to see any of your batting order data point .

What about Goldman Sachs?

Since they ’re the ones lend you money and secure each transaction , Goldman Sachs will have a record of every purchase and payment you make with your Apple Card .

Will Goldman Sachs sell my data?

Apple says Goldman Sachs has agreed to “ never share or sell your data to third parties for selling or advertising . ”

Apple makes it easy to see your transactions and spending inside the Wallet app .

What if I need to contact support?

Apple has baked Apple Card support properly into message via Business Chat . Instead of calling an machine-driven service , however , you ’ll just send a textbook and a individual will respond 24 hours a twenty-four hours , seven twenty-four hour period a hebdomad .

Find out more about ways to pay with Apple includingApple CashandApple Pay .

Apple’s smart spending analyzer will tell you how much interest you’ll owe based on your payment.

Apple makes it easy to see your transactions and spending inside the Wallet app.