Topics

late

AI

Amazon

Image Credits:TechCrunch

Apps

Biotech & Health

clime

Image Credits:data.ai

Cloud Computing

DoC

Crypto

Image Credits:data.ai

Enterprise

EVs

Fintech

Image Credits:data.ai

Fundraising

Gadgets

Gaming

Image Credits:data.ai

Government & Policy

ironware

Image Credits:data.ai

Layoffs

Media & Entertainment

Image Credits:data.ai

Meta

Microsoft

Privacy

Image Credits:data.ai

Robotics

security department

Social

Image Credits:data.ai

Space

Startups

TikTok

Image Credits:data.ai

Transportation

speculation

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Image Credits:data.ai

Podcasts

television

Partner Content

Image Credits:data.ai

TechCrunch Brand Studio

Crunchboard

touch Us

Image Credits:data.ai

After the app economyslowed for the first time ever in 2022 , things blame up pace again over the past year . According to app intelligence provider data.ai ’s annual “ State of Mobile ” report , out today , consumer spending on apps watch a modest 3 % increase year - over - class in 2023 to reach $ 171 billion across the App Store , Google Play and third - party Android app stores in China . A grow part of that total consumer spend come from apps , not nomadic game , thanks in part to TikTok ’s success . However , app downloads remained flat last year at 257 billion , up only around 1 % class - over - year .

In 2022 , the round-the-clock development of the app economy finally had a snag in a post - COVID slump as consumer expenditure renormalize and a down economy take in more people reduce their wallets . Back - of - the - napkin matheven suggested that consumer disbursement may have slowed onApple ’s App Storeas well , but it was not potential to add up up with precise figure because Apple ’s cut of transactions is no longer a categorical 30 % across the board .

Last yr , things were once again moving in a positively charged counseling , data.ai found .

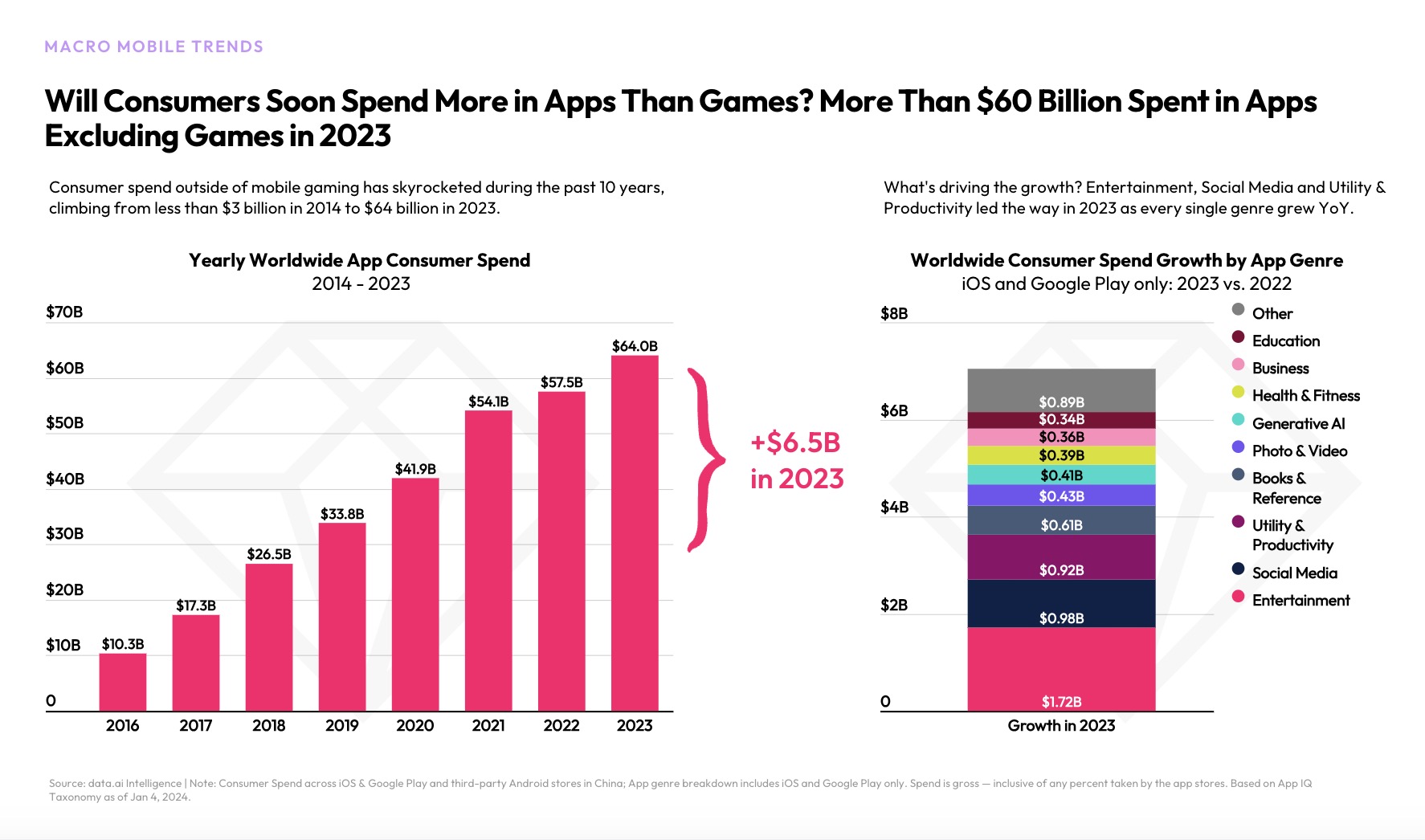

Image Credits:data.ai

Consumer spending on non - game apps grew 11 % class - over - class in 2023 to reach $ 64 billion . Social apps and the Maker economy drove this development with TikTok helping to lead the direction . Last year , the short - anatomy video app hit a unexampled milepost of more than $ 10 billion in lifetime spending , for instance , becoming the first non - game app to do so . This yr , data.ai predicts that consumer monetization in societal apps will produce 150 % to $ 1.3 billion .

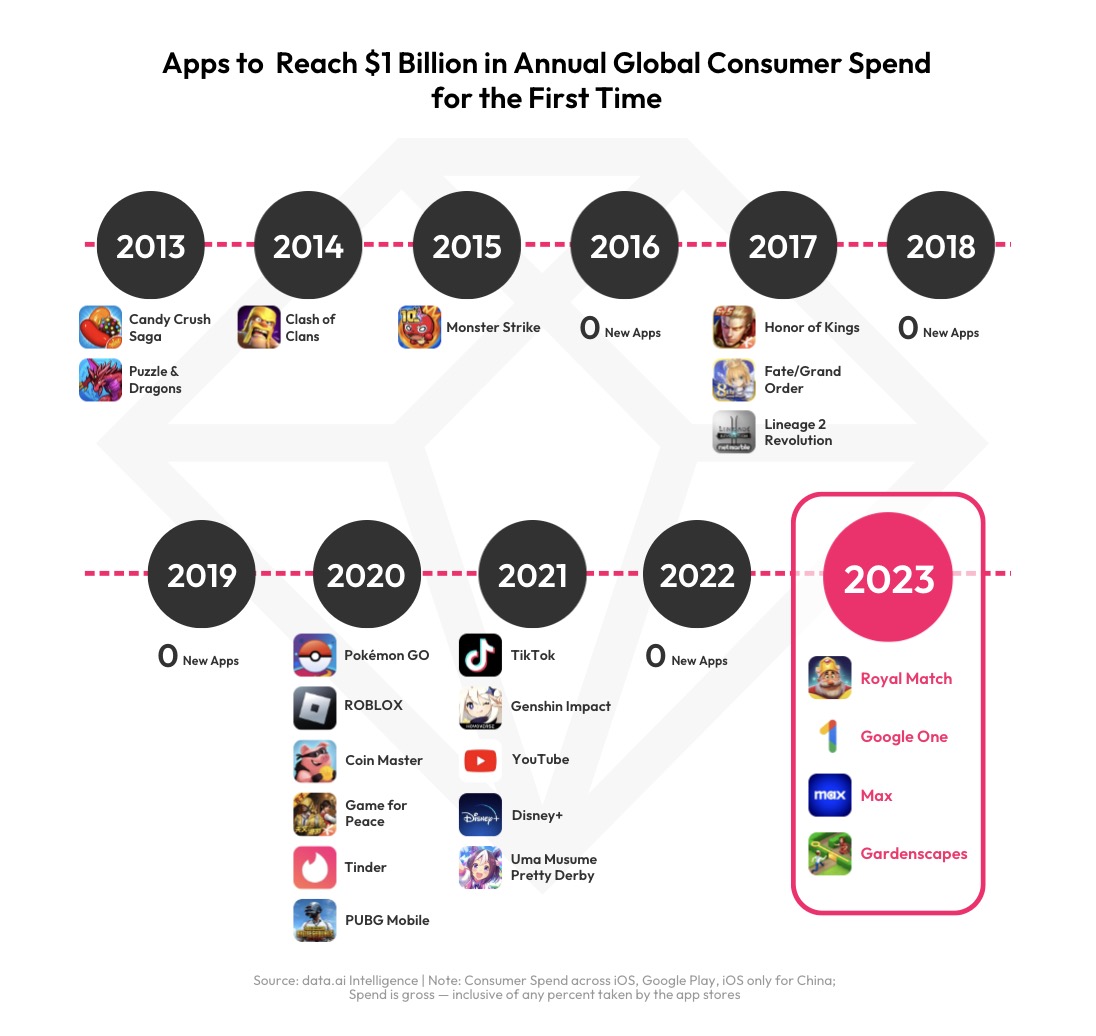

Elsewhere , more than 1,500 apps and games generate over $ 10 million annually in 2023 , while219 outmatch $ 100 million and 13 surpass $ 1 billion . Four young apps hand $ 1 billion in the year , including Royal Match , Google One , Max and Gardenscapes .

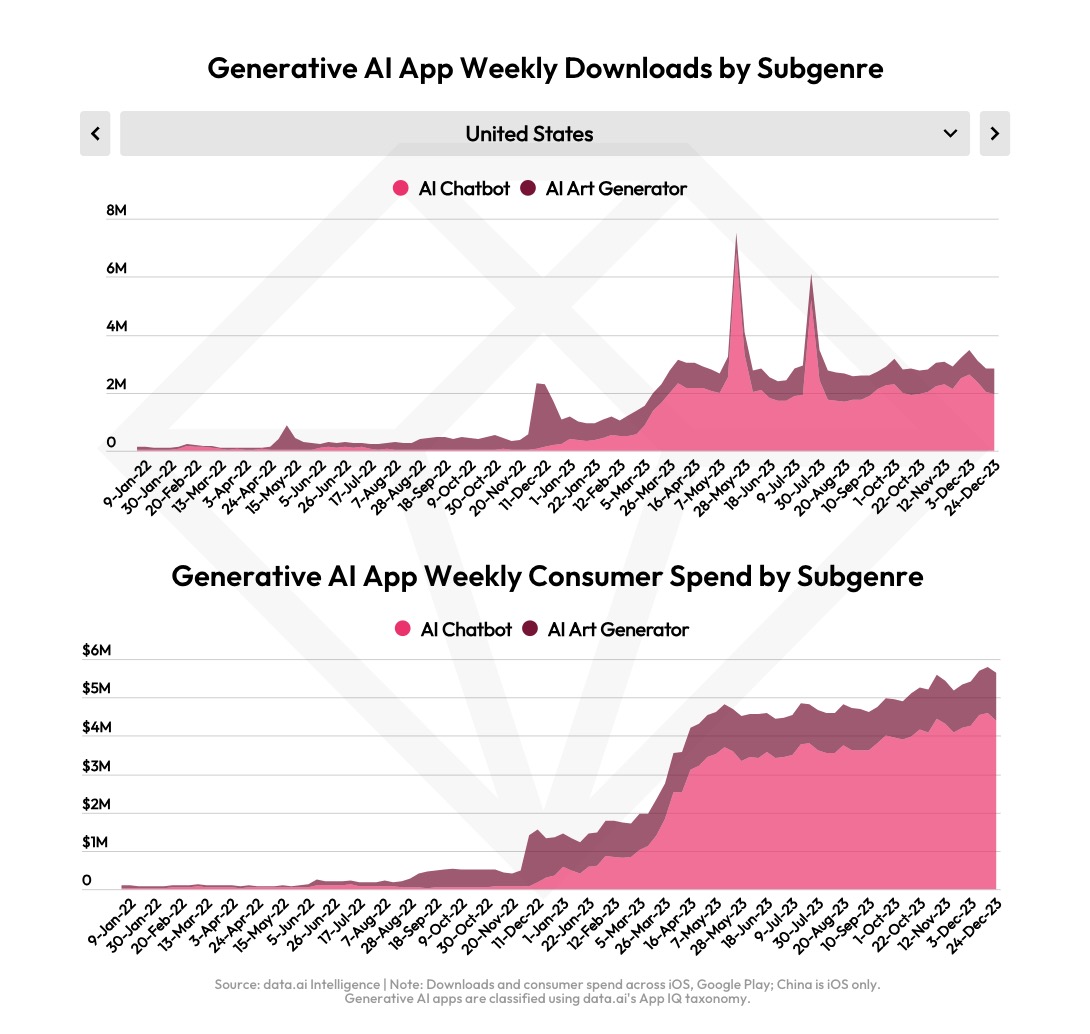

The firm also cited generative AI boost as help to fuel consumer outlay last year . The GenAI app securities industry expanded by 7x , leading to new consumer experience like AI chatbots and AI artistry generator . Top apps included ChatGPT , Ask AI and Open Chat , in terms of consumer spend . Data.ai noted that AI app popularity was “ middling global , ” but the genre did n’t rank among the breakout genres in China , Japan , Saudi Arabia and Turkey .

To capitalize on consumer demand , more than 4,000 apps tot the word “ chatbot ” to their app descriptions , and more than 3,500 added “ gpt , ” data.ai see . In accession , 2,500 apps launched in 2023 with “ chatbot ” in their verbal description — which the firm says is nearly double the apps launched in the previous four years mix .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

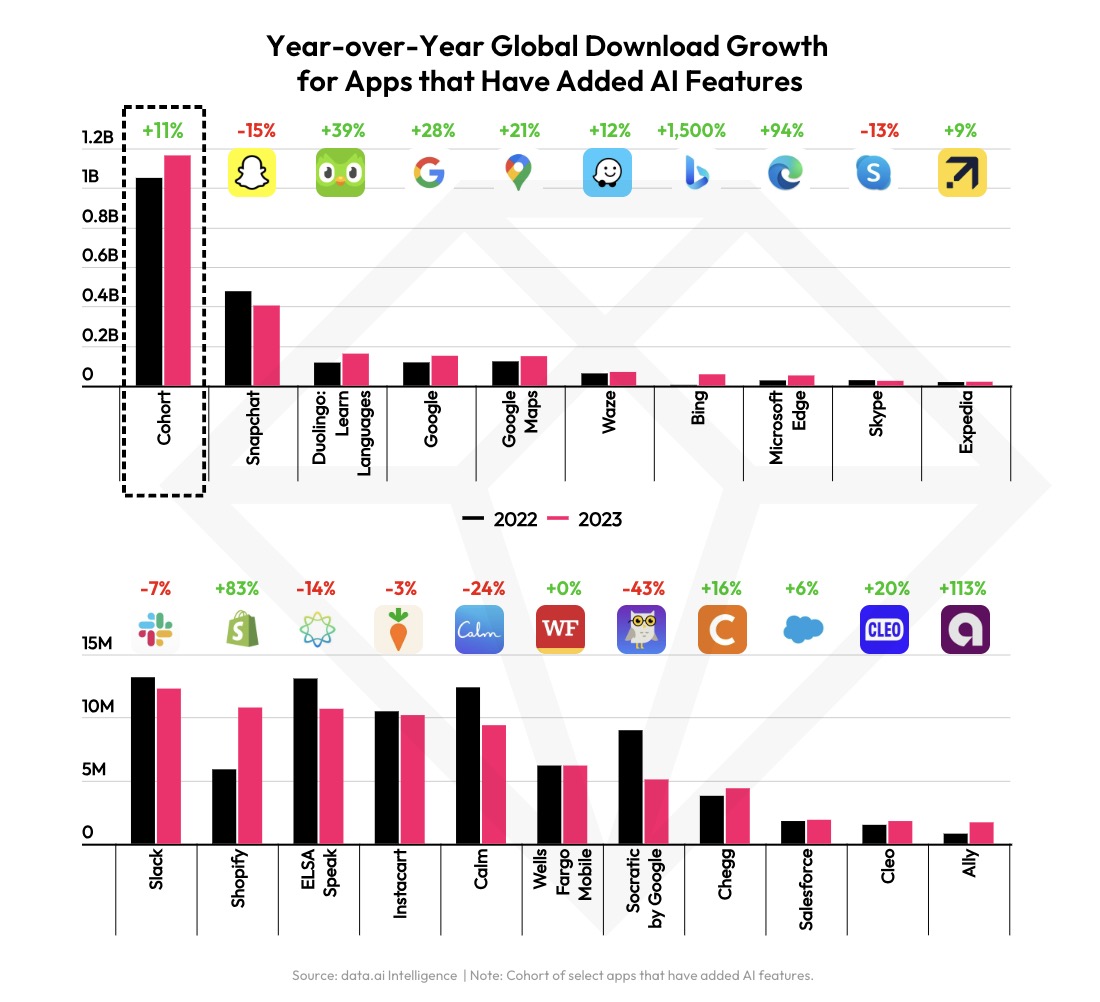

Outside of AI apps themselves , other apps adopting AI characteristic also did well in 2023 .

Twenty apps that added such feature saw 11 % year - over - year growth in downloads , data.ai found ; 13 of the 20 ( 65 % ) also saw positive growth .

The full account also cut into into other metrics of app ecosystem health , including installs , time spent , ad spend , gaming - specific details and more .

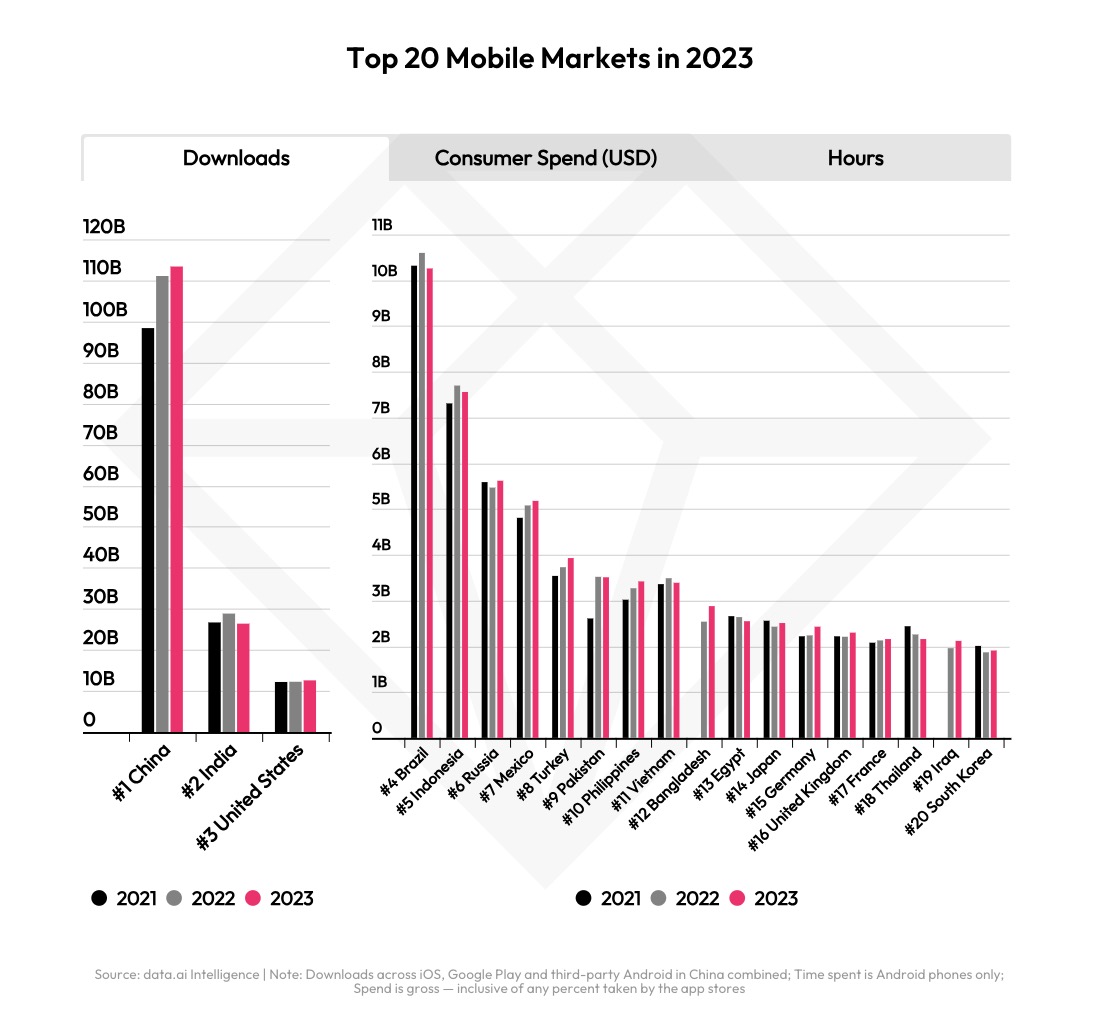

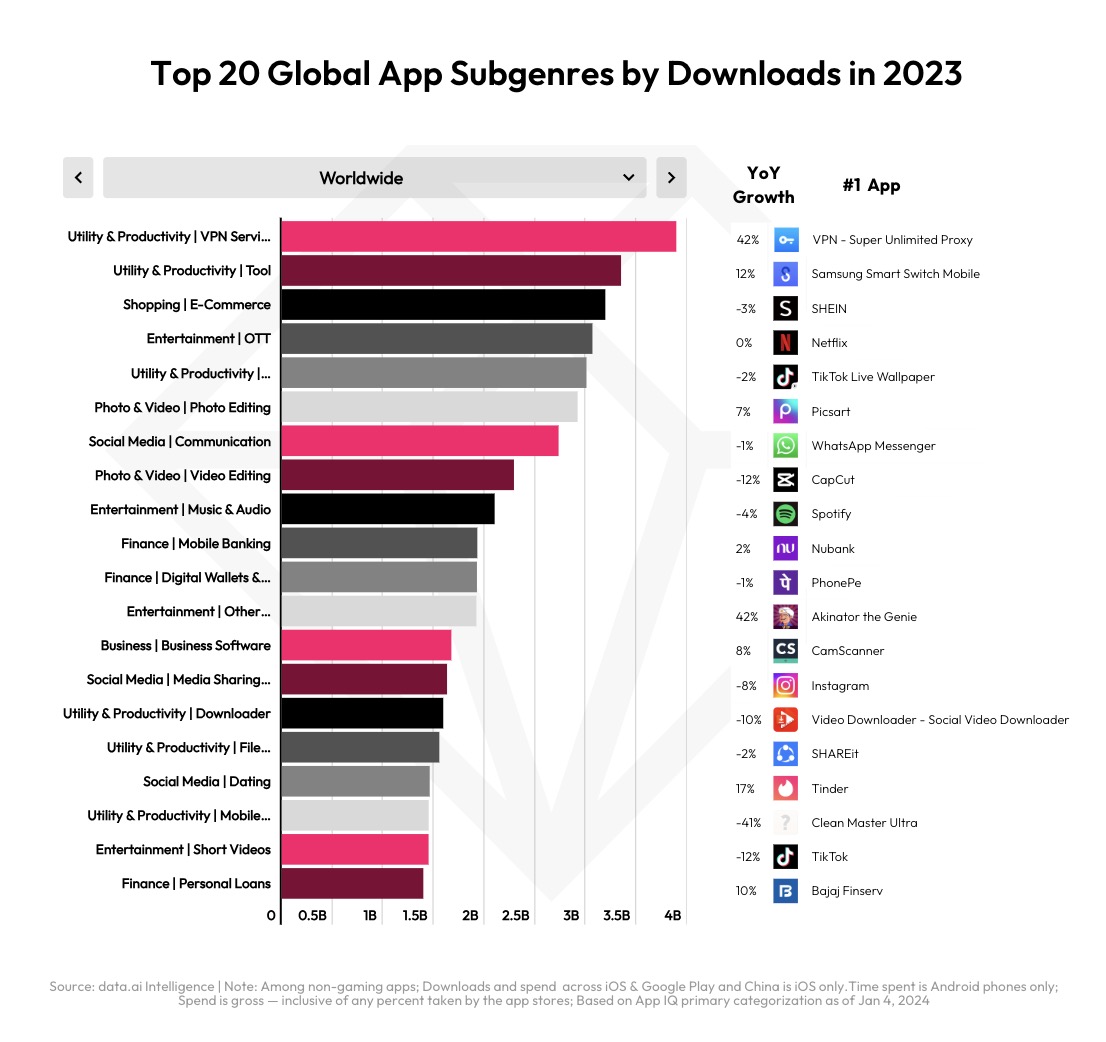

Last year , China head India ( No . 2 ) and the U.S. ( No . 3 ) in app installs , while Bangladesh emerged as the quickest - growing market . Subgenres for apps included matter like utility , productiveness apps , shopping , entertainment and photo and video .

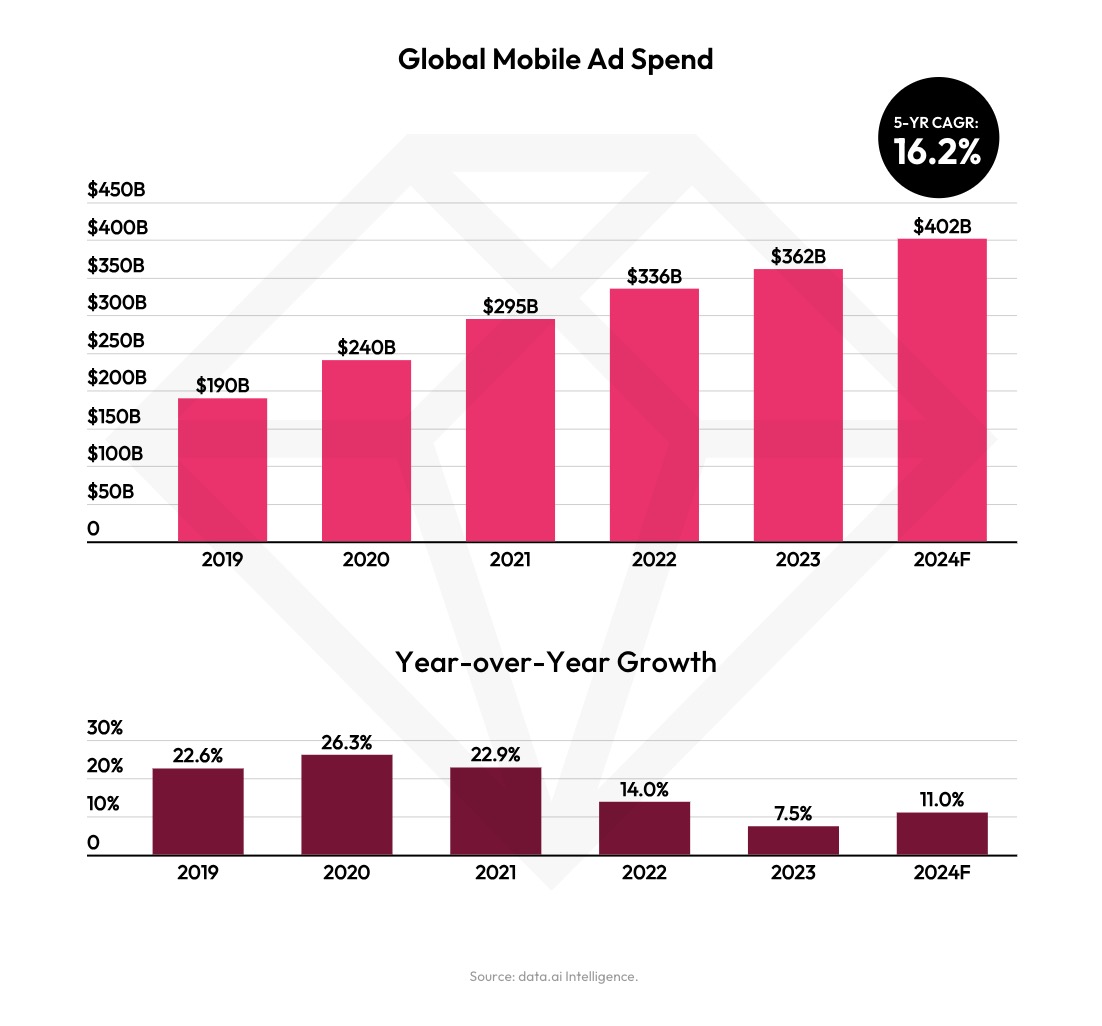

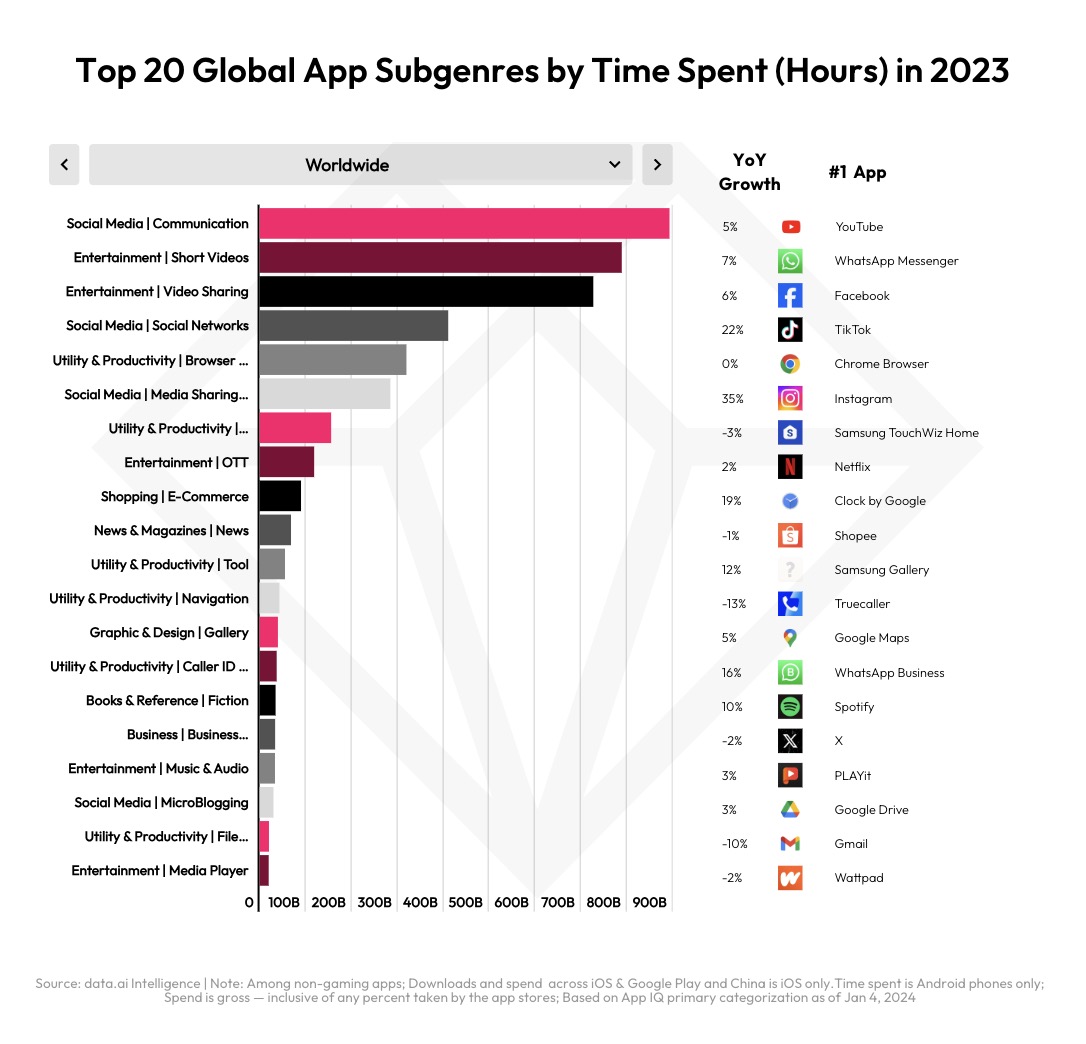

Data.ai also reported hours spent peaked at 5.1 trillion , up 6 % year - over - yr , while mobile ad expenditure is projected to reach $ 362 billion this year , up 8 % . The forecast for 2024 will see a larger startle of 16.2 % to reach $ 402 billion , data.ai estimates , as ad spending bounces back from tedious growing in 2023 .

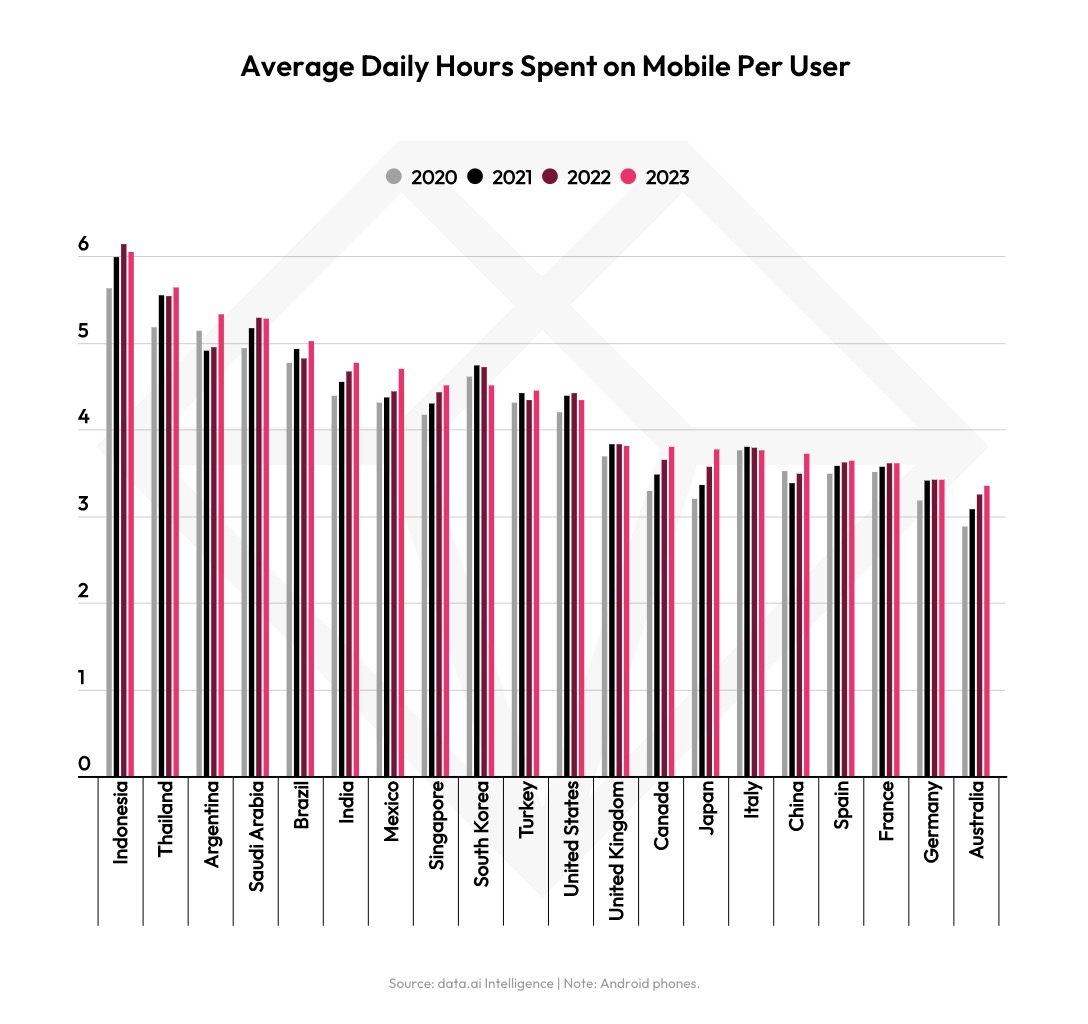

Meanwhile , across 10 top market , the mediocre day-to-day hours spent on mobile per user grew 6 % from 2022 to reach more than five hr . Here , apps like YouTube , WhatsApp , Facebook , TikTok , Chrome , Instagram , Netflix and others help boost time spend .

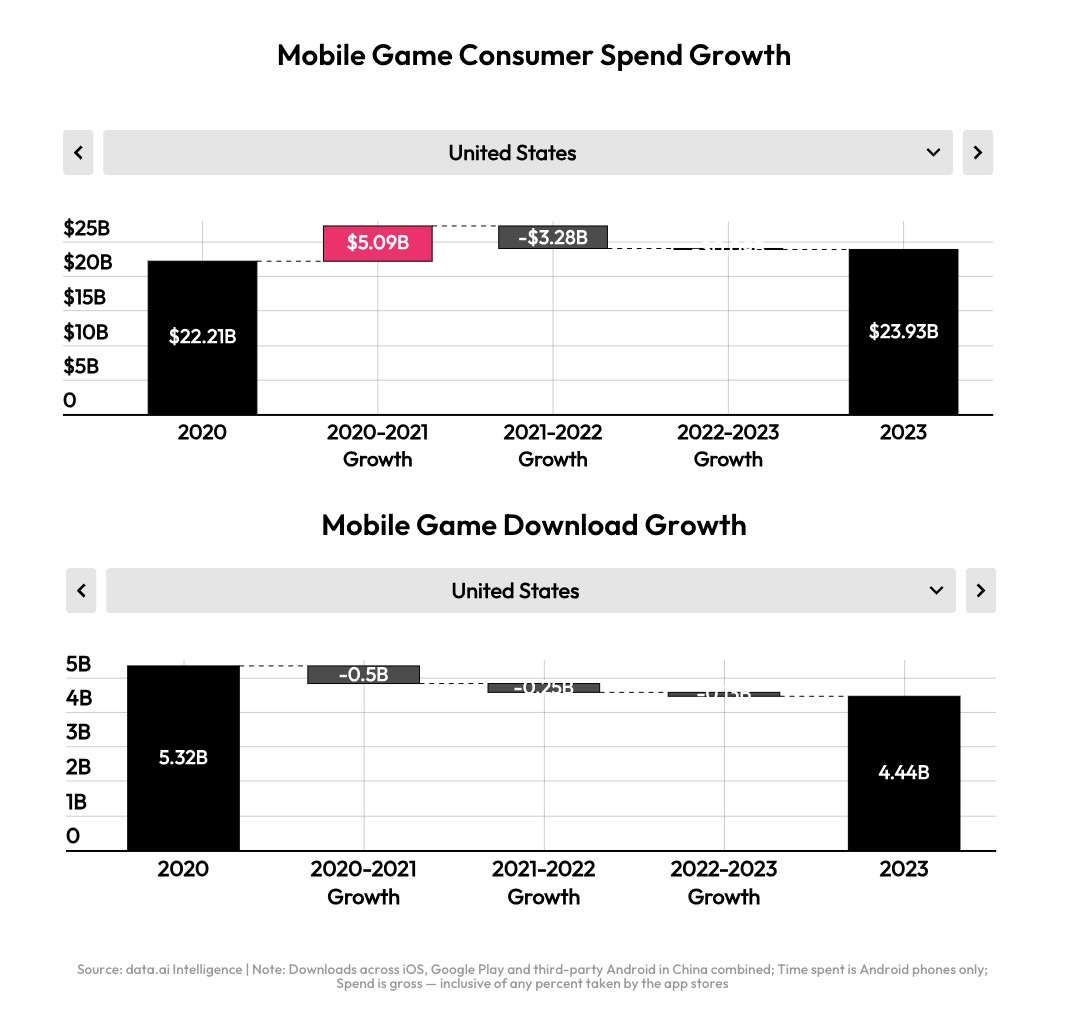

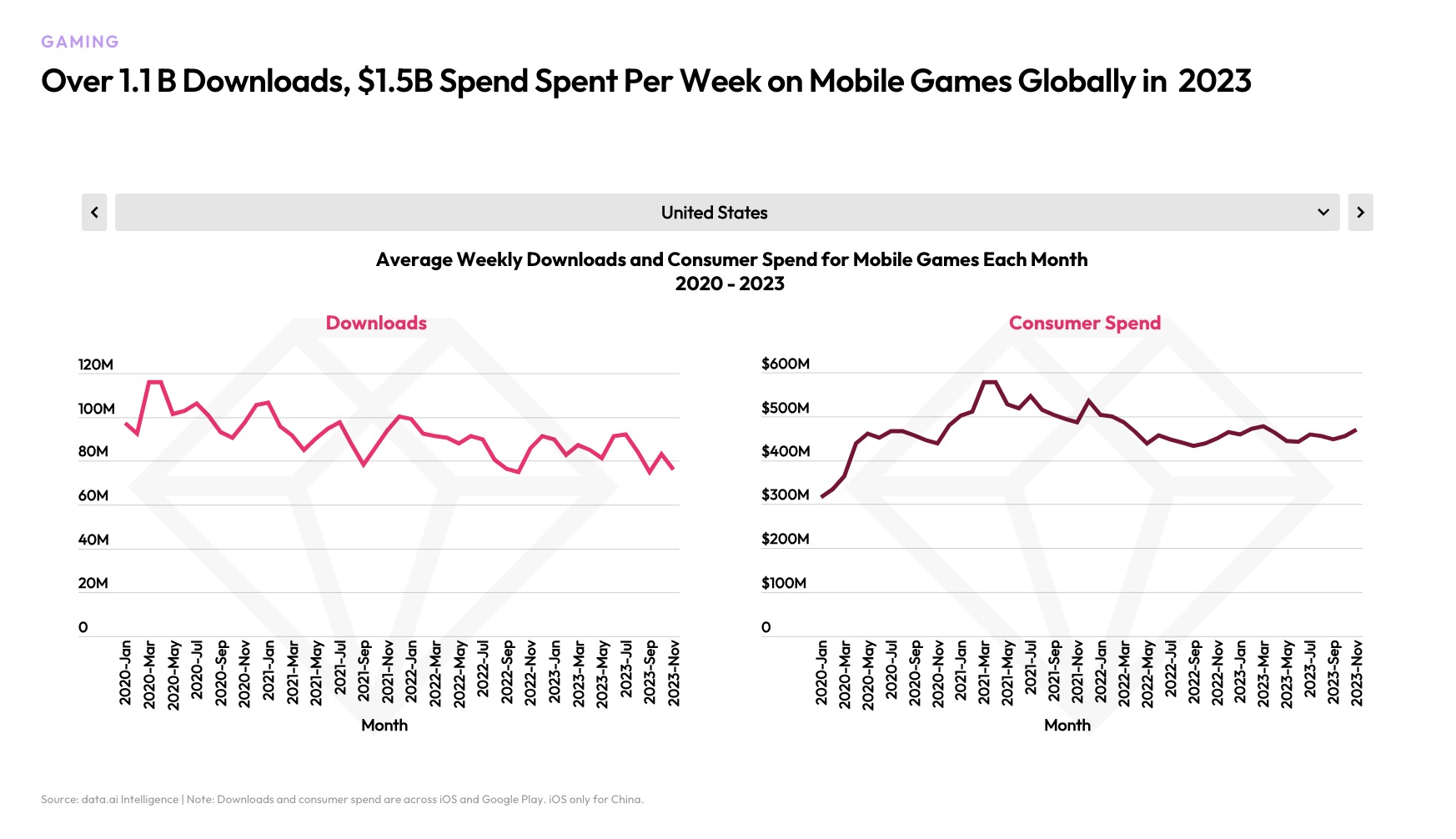

Mobile gaming , however , did not fare as well in 2023 , with spend down 2 % class - over - class to $ 107 billion . Gaming downloads were roughly in line with prior twelvemonth , accounting for 88 billion out of the 257 billion total downloads . Top genres included Hypercasual , Simulation and Action . Among the breakout games in the year were Monopoly GO and EA Sports FC Mobile Soccer . In another milestone , Genshin Impact cross $ 4 billion in lifespan spending . Games like Block Blast Adventure Master and Attack Hole drove downloads , amid surprisal hits like Avatar Life . Gacha Life 2 and Eggy Party also made big addition in downloads and usage .

Other 2023 trends saw Chinese shopping apps like Temu and Shein grow 140 % as they attain Western markets , while social and entertainment apps ’ time spend grew 12 % to 3 trillion time of day . The latter also saw spending grow 10 % to $ 29 billion .

Post - pandemic trend also continued as travel app downloads grow 13 % , driven by travel services ( 26 % ) , tour of duty booking ( 80 % ) and flight of stairs reservation ( 43 % ) . Similarly , ticketing apps jumped 31 % , thanks to big concerts by Taylor Swift and Beyonce — an increase of 66 % from pre - pandemic level .

The full report breaks down top apps and games by nation across metrics like installs , spending and time , and delves deeper into individual sector like finance , retail , picture cyclosis , societal , solid food & drink , travel , health & fitness , sports and more .

Worldwide , the top app by installs and spending was TikTok , but Facebook remain No . 1 by time spent . The top games were Subway Surfers ( downloads ) , Candy Crush Saga ( outlay ) and Roblox ( monthly active drug user ) .